There are people who are struggling to turn their ideas into reality — venture entrepreneurs. According to a survey regarding venture investment trends by the Ministry of SMEs and Startups (MSS) and the Korea Venture Capital Association (KVCA), investment in the venture industry last year totaled 4.3 trillion won, exceeding 20% of the annual investment of 3.4 trillion won last year. For the first time in 18 years, it broke the record set by the first venture boom in the early 2000s. Had it not been for the adverse effects of the COVID-19 pandemic, the heat of venture investment could have accelerated this year.

Venture companies and POSCO. At first glance, the connection between the two seems irrelevant, but POSCO’s investment and support for ventures go a long way. In 1997, POSCO established POSTECH Capital (currently POSCO Capital) to foster venture companies, and, as of present, it is striving to find the future growth engine of the company through the venture platform.

ISSUE The foundation of venture startups and its growth is vulnerable

The advent of the 4th Industrial Revolution has caused a rapid shift in the future industrial paradigm, and existing companies are facing challenges of sustainable growth. As a countermeasure, many global companies are strengthening their competitiveness and looking for new business opportunities by investing and cooperating with venture companies.

So, what is the situation of the venture industry like in Korea? As a joke, it is said that in Korea, the best graduates only start a business when they fail to find a job. The issue is not only the lack of capital and resources but the lack of excellent personnel as well. In Korea, the economic structure is centered on large companies hence it is a challenge for venture companies to advance here. Moreover, due to COVID-19, a lot of business owners are facing a hard time, which has also made it hard for entrepreneurs to start new venture businesses.

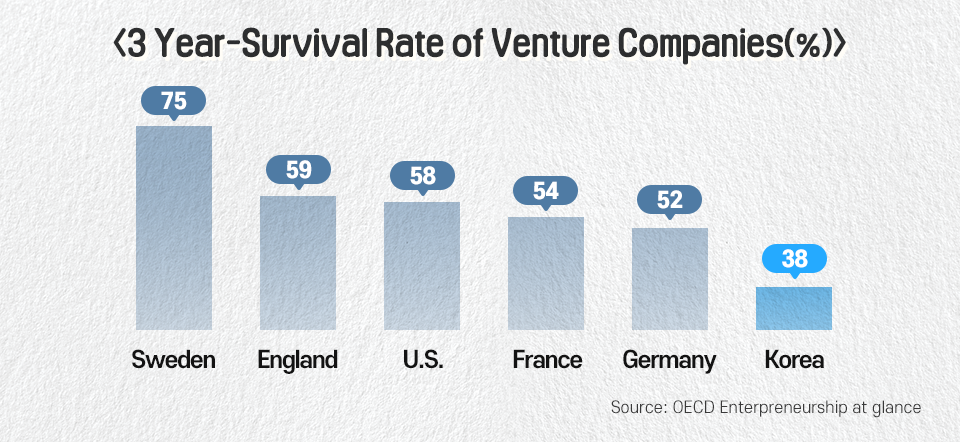

According to a survey of the Korea Chamber of Commerce & Industry (KCCI) in 2017, 62% of venture companies in Korea couldn’t survive more than three years, ranking 25th among the 26 OECD member countries. However, if it is possible to create an ecosystem where large companies and venture companies can coexist, the situation will improve. Ventures can be provided with growth opportunities through joint research and testbeds with large companies, and large companies can obtain new growth opportunities and even profits.

The reason why large companies and ventures need to share growth with cooperation could be found here.

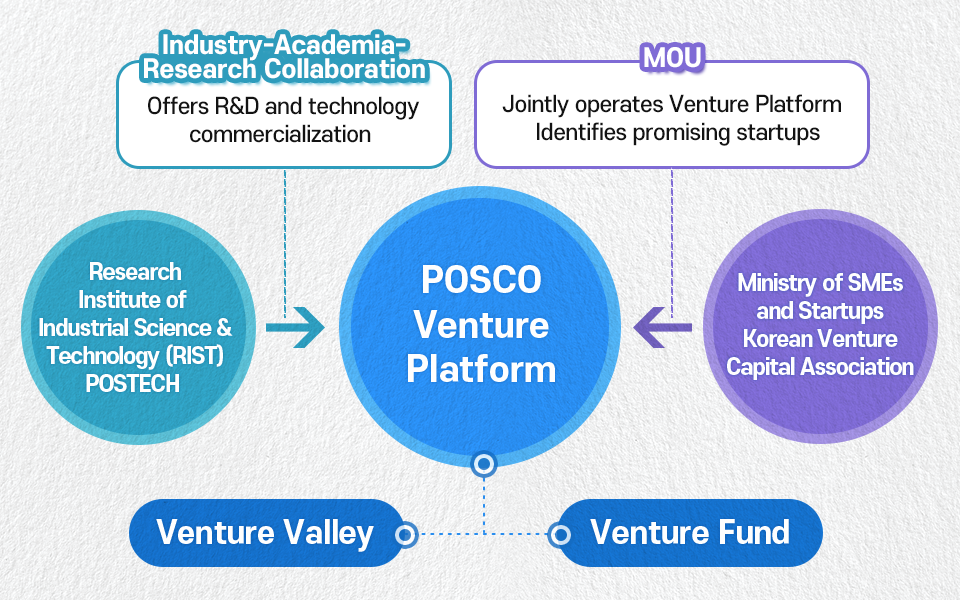

And it is also why POSCO is trying to invest in and nurture venture companies with its “Venture Platform,” which incorporates a Venture Valley and a Venture Fund. The POSCO Venture Platform utilizes its unique industry-academia-research infrastructure that includes Pohang University of Science & Technology (POSTECH) and the Research Institute of Industrial Science & Technology (RIST).

SOLUTION 1. Come to “POSCO Venture Valley”

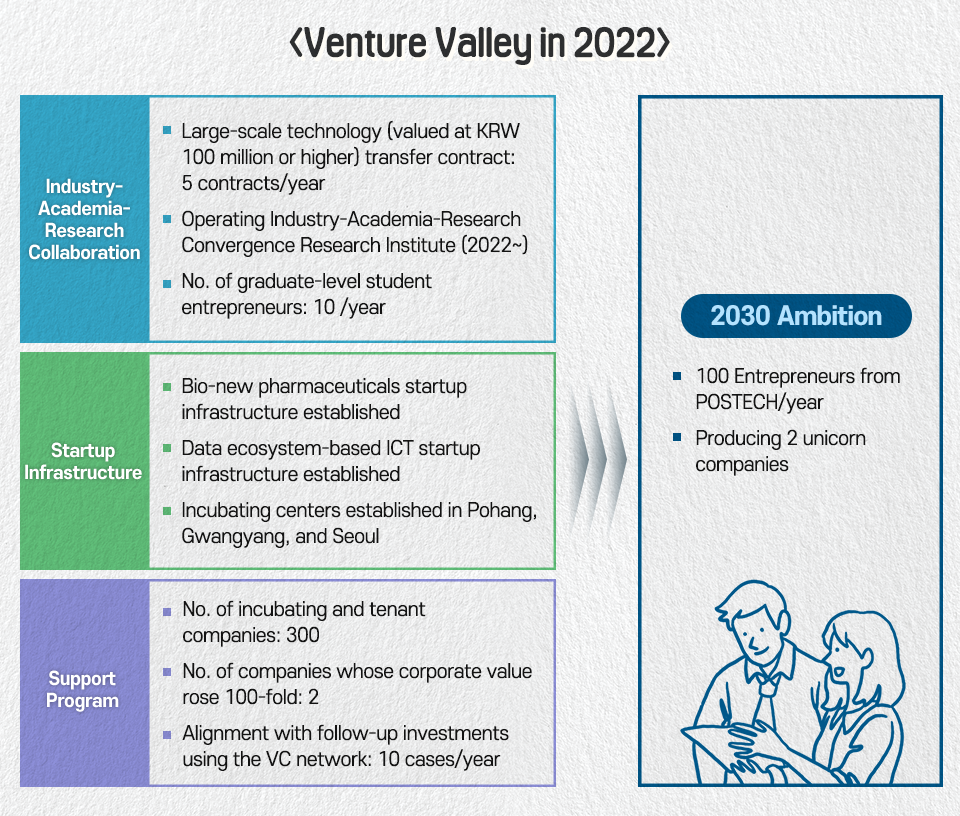

To successfully establish a sound venture ecosystem, “startups” should become more active. POSCO has been helping young venture entrepreneurs lay the foundation to grow their businesses through research, investment attraction, and technology sharing through the “Venture Valley”.

When you hear the word ‘venture’ where is the first place that comes to mind? It would probably be Silicon Valley of the U.S. Silicon Valley is a startup cluster and a jungle of entrepreneurs, housing giant technology companies, such as Google, Apple, and Tesla. The objective of POSCO’s Venture Valley is to build the world’s best venture cluster and produce unicorn companies to become Korea’s Silicon Valley.

Other large companies only participate in the investment of ventures, but POSCO aims to create a Venture Valley as well, with its outstanding venture infrastructure. The distinctive feature of POSCO Venture Valley is that it is backed up with the following factors: 1) space for startups in their early stage, 2) POSTECH, which offers exceptional talent, 3) RIST and R&D infra, that support the advancement of technologies and products, and 4) MOU with MSS and the KVCA.

To this end, POSCO decided to invest 200 billion KRW to create “Incubating Centers” for venture companies in Seoul, Pohang, and Gwangyang, and named it “Change-up Ground”. The incubator facilities would change the future of startups and act as a ground to upgrade their business.

In July, POSCO opened “Change Up Ground,” the first public-private partnership in TIPS (Tech Incubator Program for Startup Korea) Town, Seoul. TIPS Town is a Korean version of Silicon Valley that the Ministry of SMEs and Startups (MSS) has been constructing in Seoul since 2015. MSS is operating the areas Street S1 to S4, while Gangnam-gu Office runs S5. POSCO became the first private company to cooperate with MSS and opened S6.

Pohang Change Up Ground is under construction on a total floor area of 28,000㎡ with seven floors and is expected to be completed in the first half of 2021, housing more than 100 venture companies. Startup tenants can receive support according to the development phase, from startup training to initial investment. Through corporate specialized consulting and mentoring, the ventures will be prepared with a theoretical and practical foundation and participate in various events, such as the Idea Market Place (IMP) and the Venture Valley Biz-Day, where they can attract investment and advance into the market. Also, through coordination with the venture capital, which supports the Venture Valley, the venture companies can apply for the “TIPS” program, a program to support private investment-led technology startups, which might eventually lead to investment from the government. Ventures that have successfully established their foundation in Pohang and Gwangyang can promote and expand their business into the metropolitan area with a secured base on the Streets of Entrepreneurs established by the Ministry of SMEs and Startups in Seoul.

Meanwhile, POSCO launched the “Venture Valley Business Council” in September 2019. The council is to foster youth ventures by communicating with venture companies, incubators, and local governments in Pohang and Gwangyang. To promote technology exchange and benchmarking among ventures, the Venture Valley Business Council will form subcommittees of the three major business areas of POSCO Venture Valley: Materials, Energy, Environment, Bio-pharmaceuticals, and Smart City & Smart Factory. Through this, POSCO plans to provide practical support in creating a venture ecosystem, revitalizing the local economy, and creating jobs for the youth.

With the Venture Valley, POSCO not only utilizes POSTECH’s master’s and doctoral personnel, professors/researchers, but also various startup infrastructure of Pohang in order to build a Korean version of Silicon Valley in Pohang. Therefore, POSCO aims to produce 100 entrepreneurs from POSTECH per year and produce two unicorn companies.

SOLUTION 2. Here Comes the “Venture Fund”

– Investment for POSCO’s future growth also carried out through Venture Fund

Another strategy of POSCO’s Venture Platform is the Venture Fund. While Venture Valley supports in-house and external venture companies to start businesses and grow further with POSCO’s industry-academia-research infrastructure, Venture Fund invests in not only occupying companies of the Venture Valley but also aspiring domestic and overseas ventures to discover new growth engines for POSCO Group. The steel industry is a profound one centered on utilizing heavy equipment, so keeping up with the speed and determination required by the venture sector is challenging. Therefore, the strategy aims to discover new businesses through this kind of open innovation.

Attempts to discover new business ideas and technologies by investing in venture companies aren’t new among large companies in Korea and overseas. On the contrary, it has become an inevitable decision for companies in order to survive the rapidly changing business environment of the 4th Industrial Revolution era. Then, what is the investment strategy of POSCO Venture Fund that sets it aside from other large companies?

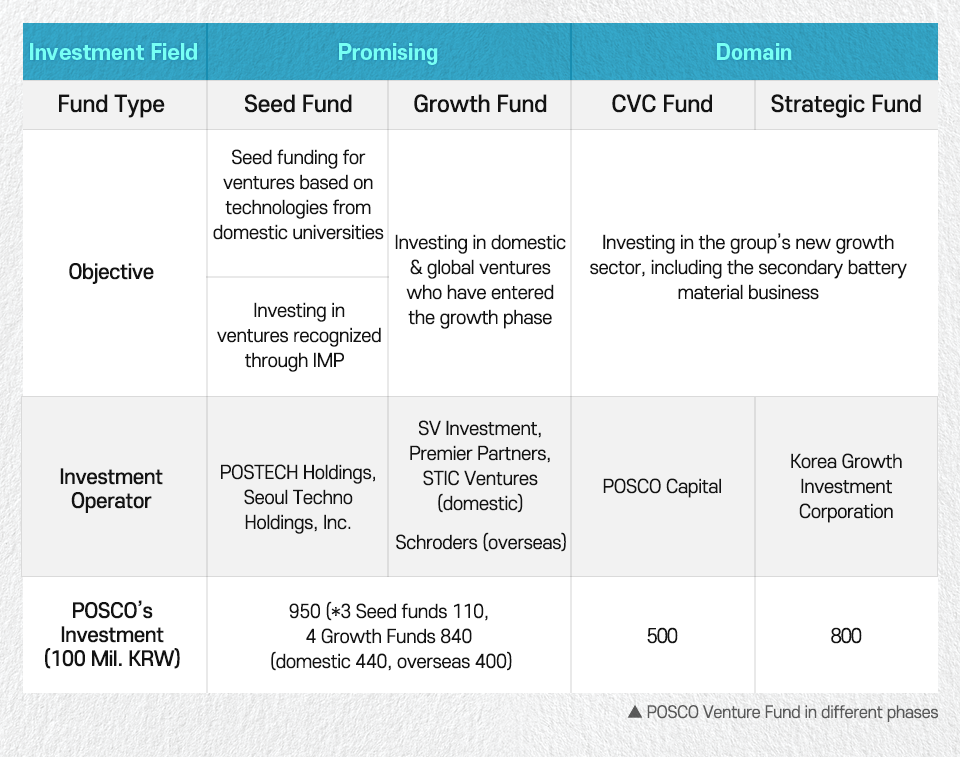

POSCO forms and operates various types of funds tailored to the characteristics of each phase of the venture business growth. POSCO’s Venture Fund is differentiated in that it supports the rapid growth of promising venture companies at each stage and executes follow-up investments in outstanding ventures, aligning them to POSCO’s new growth domains.

The investment sector of the fund includes not only new growth domains set by the company but also various promising areas of the 4th Industrial Revolution era. Promising business areas identified in the fund operation process are then included as the company’s new growth domains, which are then sought as new business opportunities to flexibly respond to the rapidly changing business environment. POSCO plans to utilize the Venture Fund investment as a subsidiary means of M&A, and make it a core operating principle to discover the company’s mid- & long-term new growth business and generate investment returns.

Funds for the promising investment field are classified into two, depending on the growth stage of the company: “Seed Fund” is one and the “Growth Fund” is the other. The “Seed Fund” will provide seed funding for newly established ventures that are based on outstanding technologies possessed by university laboratories. For this purpose, in 2019, POSCO created two Seed funds that are operated by POSTECH Holdings and Seoul Techno Holdings, and plans to expand the scope of discovering excellent start-ups of leading domestic universities in their early stages. Recently, POSCO also created the IMP Fund dedicated to supporting selected ventures of the IMP (Idea Market Place) program so that the ventures can receive continuous support for growth after the program.

The “Growth Fund” invests in domestic and overseas venture companies that have entered a rapid growth stage after the venture’s new idea has gone through initial verification in the market. It is operated through collaboration with the best investment operators. As of 2019, there are three domestic Growth Funds operated by SV Investment, Premier Partners, and STIC Ventures, and they are currently being invested in ventures.

Through overseas funds, POSCO plans to read the trends of advanced technology in high-tech and promising fields at an early stage and discover aspiring global ventures based in Silicon Valley. In 2019, “Schroders” was chosen as the investment operator, and the fund was utilized as Fund of Funds to invest in promising overseas ventures. By utilizing the investment operator’s global venture network, POSCO hopes to support overseas investment and entry into the global market, which are essential factors for the quantum jump of domestic venture companies.

Since last year, a total of 95 billion KRW was invested in “Seed” and “Growth” funds investing in these promising fields, and investments will continue in the future as well.

The funds investing in the domain field focus on new growth domains as their main investment field, including the secondary battery material business field, which POSCO is currently pursuing as a new growth engine. In 2019, 50 billion KRW was invested in the “CVC Fund,” and in August 2020, an investment plan of 80 billion KRW was confirmed for the “Strategic Fund,” laying the foundation for investment in the entire growth cycle.

The “CVC Fund,” which is operated by POSCO Capital, is created with POSCO Group funds only and is used to invest in outstanding ventures within the domain. The fund seeks to increase strategic links by partnering with the investment operator from the early stage of the venture. The “Strategic Fund” is a fund investing in venture companies that meet POSCO’s new business strategy and have grown beyond a particular scale. With outstanding external operators, like the “Korea Growth Investment Corporation,” the fund is to be used in expanding the scope of discovering outstanding companies and increasing the scale of investment.

The venture fund is planned to be created based on 800 billion KRW, and the fund strategy will continue to be operated yearly in line with changes in the domestic and global venture investment market and the direction of the group’s new business strategy. In addition, POSCO plans to continue the venture fund in the long-term by utilizing the profits generated from the fund.

Also, POSCO will further enhance cooperation with outstanding domestic investment operators and leading investment institutions, such as KDB Bank, Korea Venture Investment Corporation, and Korea Growth Investment Corporation, that are jointly participating in the existing funds, and strengthen the network with the global venture investment industry.

With these endeavors, POSCO Venture Fund will be able to play a part in the growth of young entrepreneurs, who will become new engines of national competitiveness, while discovering venture companies with potential and nurturing them as new businesses of the company.

※ POSCO Idea Market Place Cases

POSCO has been operating the “POSCO Idea Market Place,” a program to discover and nurture startups in early stages, since 2011. The Idea Market Place is one of the POSCO Venture Valley programs, which is open to prospective entrepreneurs and ventures of less than 3 years. The applicants go through selection & investment, education & mentoring, the IMP event, connection to TIPS, and follow-up management.

Following accounting and investment evaluation, the selected ventures can receive benefits in connection with POSCO’s seed money investment or “TIPS,” which is the government’s private investment-led technology startup support program. For the past ten years, POSCO has invested 17.6 billion KRW in a total of 102 companies. An AI-based rehabilitation device & content developing company that POSCO directly invested in 2012 succeeded in listing on the KOSDAQ last year. Another English education content developing company, which received investment in 2013, grew to achieve a corporate value of up to 150 billion KRW.

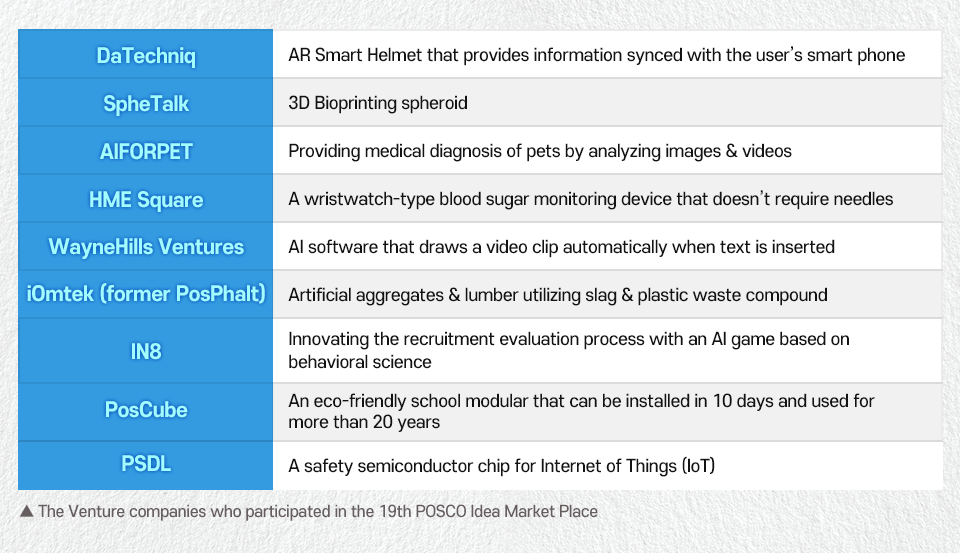

Below are the venture companies selected at the 19th POSCO Idea Market Place.

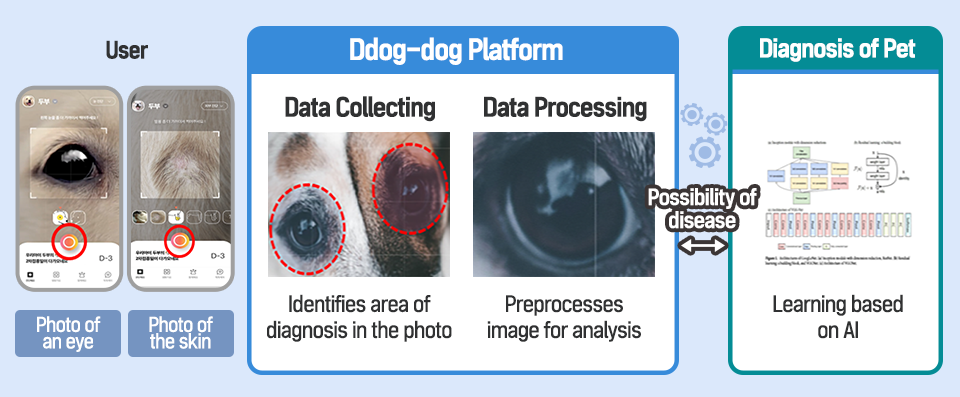

Through the Ddog-dog application on the phone, the company provides a pet medical platform service where users can upload the photo of their pet’s eyes or skin to receive information on the pet’s health condition through artificial intelligence-based learning. Based on Deep Learning, the service is known to be 90% accurate in diagnosing eye and skin diseases.

DaTechniq aims to develop a helmet that can implement AR, including navigation and mobile phone functions, and advance not only to the motorcycle user market but also to various industries using helmets to become a pioneer in the AR helmet market. It is already participating in joint development on connecting the helmet to motorcycles with a Chinese corporate, and joint high-speed safety tests are being conducted. The trial package will be sold after being applied to 70,000 KR motorcycles in 2021, and the KR Motors AS network in China is to be utilized.

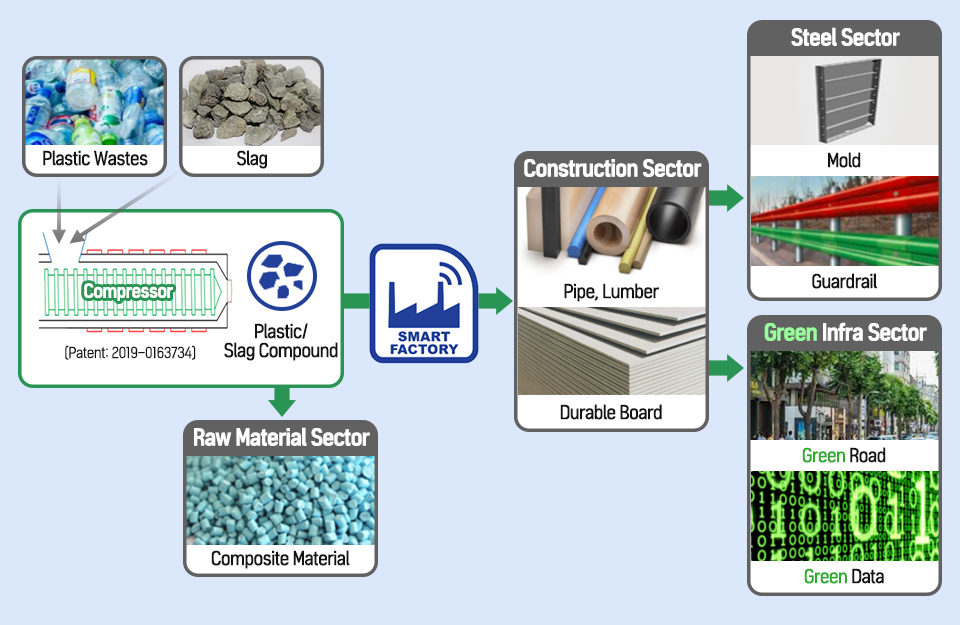

iOmtek is POSCO’s in-house venture that combines by-product slag and waste plastics to produce materials for construction and infrastructure use. The company combines waste plastics, fillings (slag, glass, rock, etc.), and additives and extrudes them to produce the basic composite. The composite is then shaped into various forms with appropriate molds. The materials, which possess excellent durability and mechanical properties, are to be applied for construction and infrastructure use.

The Venture Platform is what POSCO has prepared for venture companies that will lead the future with creative ideas and passion! From Venture Funds worth 1 trillion KRW and Venture Valleys to the Idea Market Place for entrepreneurs, POSCO will continue to invest in venture companies to secure new growth engines and revitalize the local economy.

[Corporate Citizen POSCO’s SOLUTION] Series

· #1 POSCO ‘Employees’ Giving Program: “1% Sharing”

· #2 ‘Sharing’ Competitiveness, ‘Sharing’ Growth

· #3 POSCO’s Beloved Friend: The Ocean

· #4 Young Man, It Ain’t Over till It’s Over

· #5 Collaboration & Art Become CollaboARTion

· #6 Shifting the Paradigm of Childbirth

· #7 Sharing Growth with SMEs, “Benefit Sharing”

· #8 Cultivating the ‘Dreams’ of Future Generations