In 2014, China’s GDP growth rate increased 7.4 percent from the previous year. This might seem like a large number, but in fact, it is the lowest level of growth since 1990, when the rate was 3.9 percent. The number signaled a clear change in China’s growth levels.

As a result, in December of the same year, Chinese President Xi Jinping declared that China formally entered an era of xin chang tai. In English, the term translates to “new normal” or “a new state of normality.” His statement acknowledged the nation’s slowing growth and addressed the need to create a growth structure centered on investment and innovation.

China’s “new normal” is about transitioning to this new way of growth. Changes in the country’s economic fundamentals, including the “new normal” market environment, also apply to the Chinese steel industry. As a result, the industry, too, is searching for new solutions.

Shifting Gears

Over the past few decades, the Chinese economy grew at unprecedented rates, which caused a variety of problems both domestically and internationally. Rapid growth was accompanied by adverse effects, such as regional and socioeconomic inequality, environmental pollution, abuse of natural resources and overcapacity.

In the “new normal” era, China aims to address current economic and social issues while seeking growth through innovation. To achieve this goal, Xi Jinping created a five step “new normal” plan.

The first step is to adopt new technologies and business models to increase the utilization of private capital and the diversification of investment sources. The second step is to satisfy a broad spectrum of consumer demands. The third is to focus on high-tech industries to attract foreign capital. The fourth is to reinforce quality-based market competition structures. And finally, according to the five-point plan, there will be a strong emphasis on conserving resources and protecting the environment.

The Three Lows

The “new normal” era signals a major economical shift for China. The far reaching changes in the nation’s economic fundamentals are characterized by “three lows.”

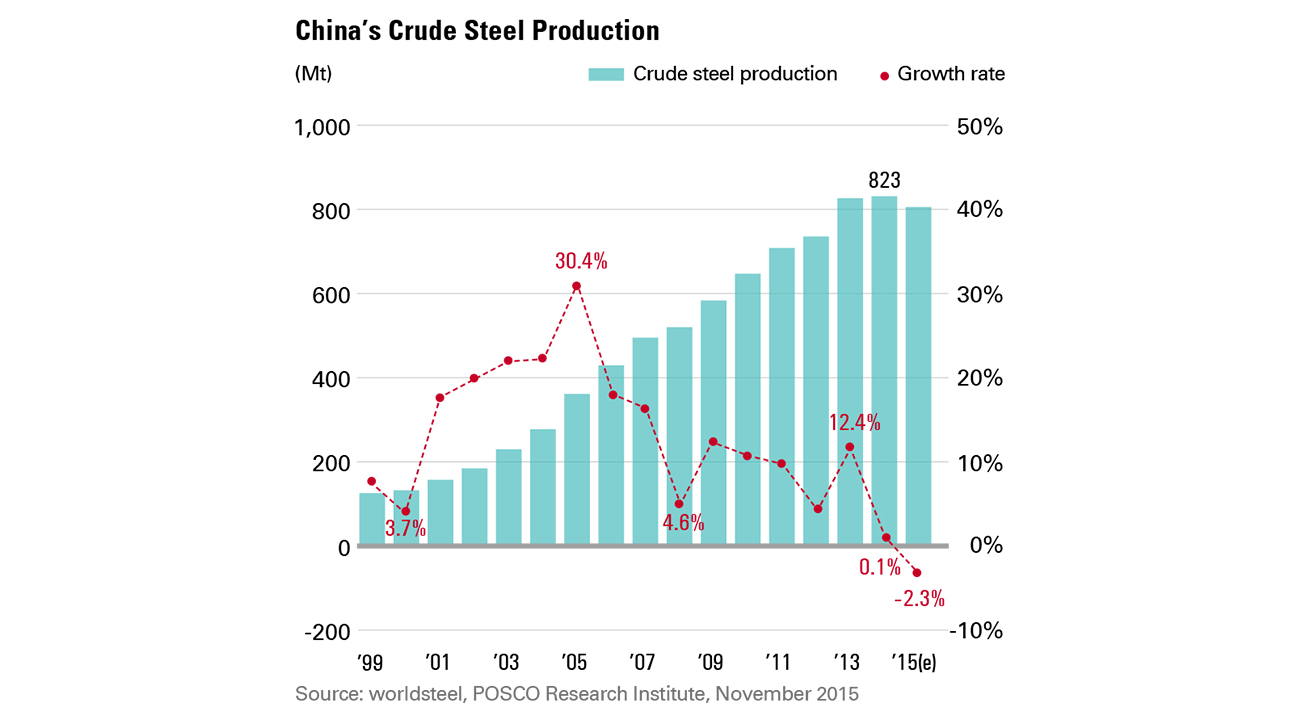

The first low involves China’s steel production and consumption. Both of these areas are facing low growth, and an early peak is considered to be fast approaching, according to experts. The China Iron and Steel Association (CISA) estimates that the country’s crude steel production recorded negative growth in 2015 for the first time since 2000.

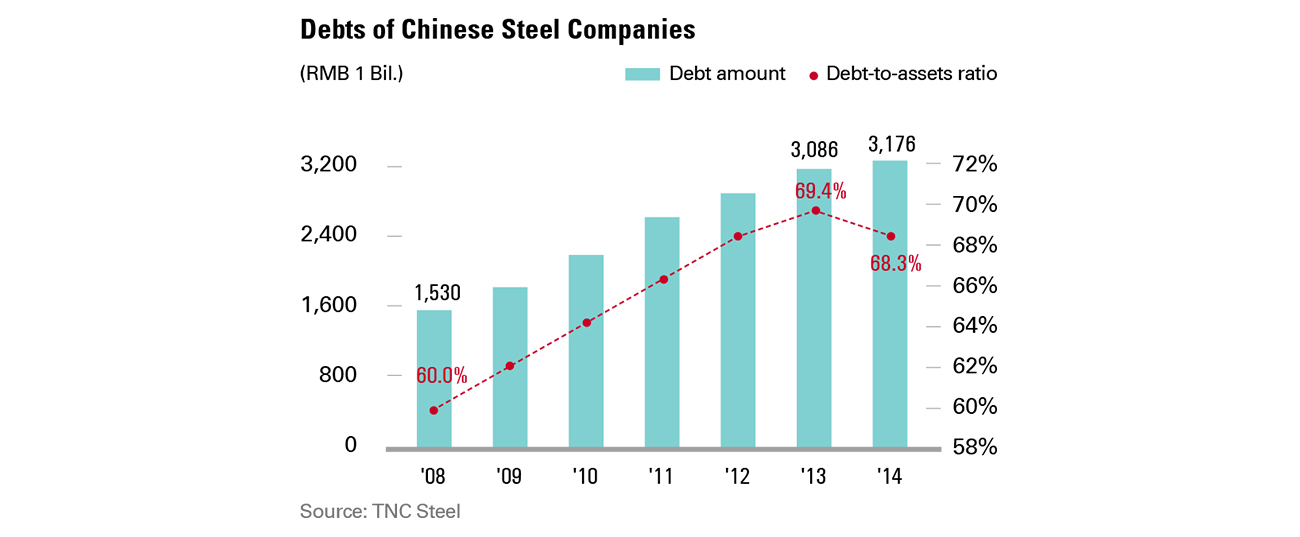

Second, steel prices have been declining steadily, due to oversupply related to overcapacity, intensified price competition and pressure from the excess supply of iron ore. China’s crude steel production led the global “raw materials super cycle” in the 2000s, but its slowdown is gradually freezing demand for iron ore.

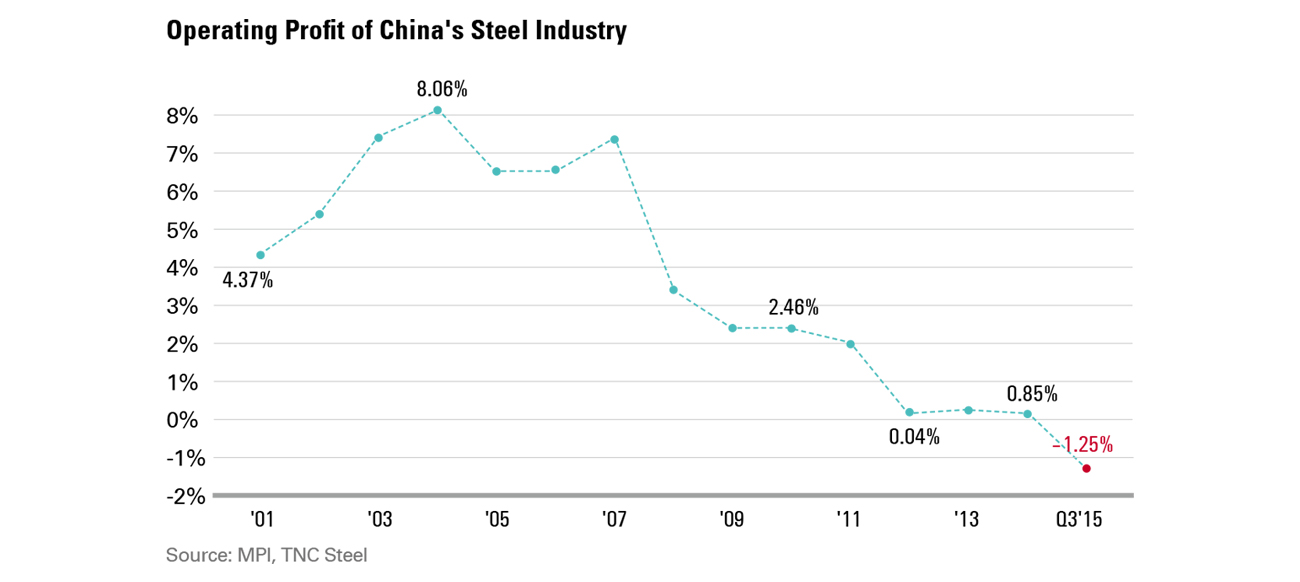

Third, China’s steel industry is transitioning from a period of low profit to a period of zero margins. The industry’s pretax profit margin was as high as 8 percent in 2007, but the figure has barely remained above zero in recent years, recording 0.04 percent in 2012, 0.48 percent in 2013 and 0.85 percent in 2014.

Transforming China

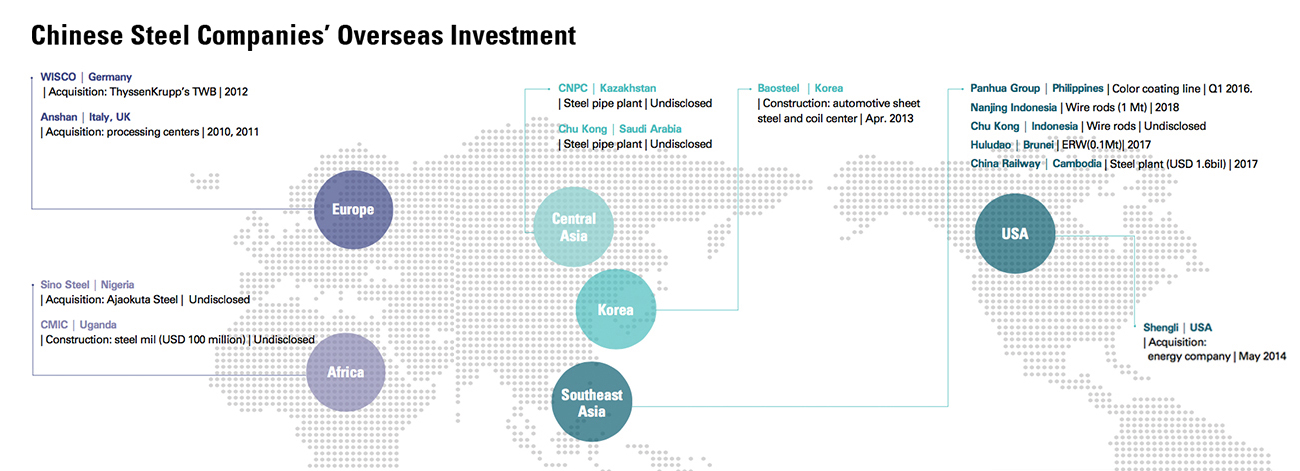

In the new era, China’s steel industry aims to overcome crises through four major strategies. First, steel companies are actively building overseas production bases and seeking export markets to relieve domestic oversupply. Second, steel companies are pursuing survival through integration that transcends ownership schemes and regional borders.

Companies are also fostering non-steel businesses to make up for the faltering steel market. CISA estimates that China’s steel industry derived over 90 percent of its gross profit from non-steel businesses in 2013 and 2014.

Finally, the steel industry is improving profitability through advanced technology and improved product quality. Additionally, it is increasing brand power, upgrading operation technologies and making drastic changes to business models.

Developing these areas is important because, according to experts, the competitiveness of the steel industry now depends on advanced operation technologies, brand innovation and IT services more than ever.

The Future of Steel in China

A CISA representative forecasted massive transformations in China’s steel industry. Two of the major projected changes expected to occur in the next five to ten years are increased exports and entry into overseas markets. These signs of change are already visible, as the Chinese government recently opened the doors of its steel industry to foreign capital.

Exports have soared due to the depressed domestic steel market, and government policies to move steel facilities overseas are being put into effect. Experts agree that this move will have a positive impact on China’s steel industry.

The Chinese steel market is expected to expand further, as steel companies are predicted to double their efforts to increase exports and enter overseas markets. The opening of the nation’s steel industry will no doubt bring about changes for the global steel market, especially considering that China makes up half of it.

Related Link:

In Southeast Asia, Surging Imports Lead to Rising Trade Barriers

The Future of Manufacturing in Korea

The Evolution of the Steel Production Process

The Myth and Reality of Global Steel Overcapacity

POSRI Releases First Edition of Bi-Annual English Journal “Asian Steel Watch”