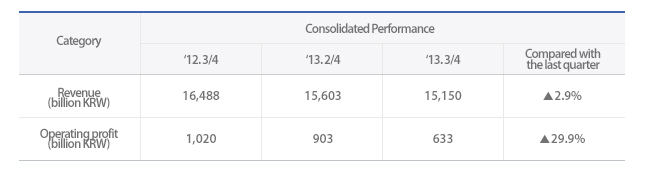

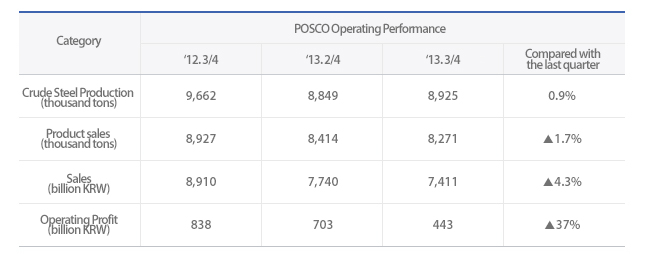

POSCO alone marked 7.4114 trillion won in sales and 442.7 won in operating profit. POSCO further strengthened its financial soundness in the third quarter. In particular, their debt ratio went down by 7.8% to 82.7% based on the consolidated financial statement, and POSCO alone marked a debt ratio of 27.5% reduced by 3.8% with a non-liability fund of about 2 trillion won raised through issuance of hybrid securities and sales of treasury stock.

In the third quarter, both sales and operating profit were reduced compared with the last quarter due to a depression in demand, a selling price fall and rising cost of feed stocks during the off-season worldwide, along with cut-production policies followed by an unprecedented power shortage, but POSCO managed to minimize the decrement through product differentiation and cost-reduction measures.

The market share of the ‘world-best’ products that POSCO produced with its world’s top three technologies and economic feasibility such as high-strength tire code and eco-friendly AHSS (Advanced High-Strength Steel) and the ‘world-first’ products that POSCO developed for the first time in the world has continued to increase, and in the end, reached 22.5% from 15.5% in the third quarter of the last year.

In terms of cost reduction, a total of 494.7 billion won was saved including 223 billion won in the cost of raw materials, 75 billion won in material costs and 121 billion won in expenses.

In addition, POSCO made a significant achievement this quarter in expanding its energy and material markets that were promoted in keeping with the upcoming age of slow growth in the iron and steel industry. Based on the consolidated financial statement, operating profit in the steel market reached 3.5%, whereas operating profit in energy and chemical materials markets marked 7.5% and 4.1%, respectively, and accordingly exceeded operating profit in the steel market.

POSCO predicted that the global demand of steel will recover in the fourth quarter. It is expected that the Chinese steel market will begin to recover as the overstock problem, which was the main reason behind the weakening of steel prices in the Chinese market, is solved, together with an increase in stock and imaginary demand in the course of preparing for the Chinese New Year. Moreover, the global steel demand in 2014 is expected to reach about 1 billion tons along with a stable increase of 3% in demand as there is an indication of an increment in moderate demand among advanced countries with signs of economic recovery.

In line with the business recovery in the fourth quarter, POSCO plans to concentrate all its efforts to strengthen the high value-oriented in-depth marketing, and therefore improve business performance. The plan is to promote the total-solution marketing activities through which customer-oriented service is provided in the entire process from product designing to sales, in order to increase the market share of the world-first and world-best products, and at the same time, amplify the synergy between its subsidiaries by concentrating on the capabilities of the main business.

Meanwhile, POSCO announced the sales goal of 63 trillion won based on the consolidated financial statement, and of 31 trillion won for POSCO alone this year, and the consolidated investment of 8 trillion won, and alone, 4 trillion won.