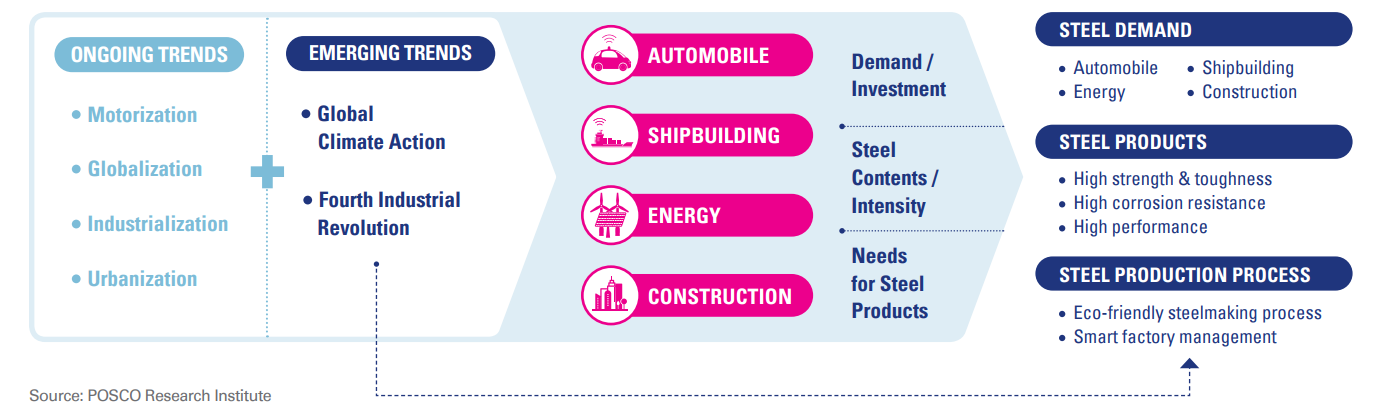

The latest issue of POSCO Research Institute’s Asian Steel Watch highlights megatrends that will shape the future of the steel industry: urbanization, motorization, globalization and industrialization. Together with these ongoing megatrends, two emerging trends – global climate action and the Fourth Industrial Revolution – are expected to affect steel demand, steel products and the steel production process.

Read how these megatrends and the expansion of the four largest steel-consuming industries have driven the growth of the steel industry from the last fifty years and will continue to play a crucial role.

Future Cities and Changes in Steel Materials

Urbanization is a key driver in the development of the global construction industry and will further accelerate in the future with rapid industrialization in developing countries and the shift to a knowledge economy in advanced countries.

Within the overall shift toward urbanization, many countries are actively crafting policies to develop their cities as globally competitive megacities. There is an increasing number of megacities with over 10 million inhabitants as the competition paradigm shifts from competition among countries to competition among cities.

Also, with a growing sense of urgency in improving the environment in terms of ozone depletion, climate change and energy and resource exhaustion, eco-friendly, green cities are emerging as a new trend.

Lastly, smart cities, characterized by digital transformation and energy revolution, will rapidly expand in the future drawing on the Fourth Industrial Revolution.

Following the ongoing and emerging trends of urbanization and future cities, new advanced steel materials are required to accompany emerging trends and accelerate the development of megatall, eco-friendly and smart products. Conventional steel materials for construction, such as steel bar and section, will improve in functionality with higher strength, thermal conductivity and better sound isolation. They will also be developed as composite materials and new materials such as carbon nanotubes and shape memory alloys will be widely deployed in construction processes. However, as construction costs (labor costs and the use of high-strength steel materials, for example), increase, steel content per unit of construction investment is expected to decline.

A New Mobility Paradigm

Led by high-income earners, lower car prices and improved road infrastructure, the key trend for the automotive industry is motorization. Today, automobiles are no longer just a means of transportation but becoming a major arena for IT competition with the rise of electric vehicles, robotic vehicles and new mobility services.

As a response to global warming, electric vehicles and energy-efficient self-driving cars are becoming increasingly widespread along with the rise of new innovative mobility services, such as robo-taxis and self-driving mini-buses.

In the case of EVs, less auto parts will be required as metal parts such as powertrain components – the engine, vehicle intake and exhaust system, and transmission – will be replaced by batteries, motors, and electronic parts. As cars are made lighter to improve driving range, alternative materials such as aluminum and CFRP are being used in some luxury lineups.

In order to retain its competitiveness and also meet increasingly strict environmental regulations, the steel industry is developing lighter and stronger steel materials such as advanced high-strength steel (AHSS) to replace traditional steel products. Steel, a strong and economically competitive material, remains an attractive choice for both EVs and self-driving cars.

Recovery of the Shipbuilding Industry

Technological advancement as a result of the Fourth Industrial Revolution and changing environmental regulations will bring considerable changes to the shipbuilding industry.

The shipbuilding industry, which boomed in the 2000’s, experienced a downturn after the 2008-09 financial crisis. Although the oversupply will linger until 2025, the shipbuilding market will then turn to an upswing with increasing growing global trade and rising demand for ship replacement.

With the development of ultra-large container ships, LNG-fueled ships, electric ships, CO₂ carriers, polar ships, and environmentally–friendly equipment, high-strength steel for ultra-large and lighter ships and high-strength low-alloy steel for safe and affordable LNG and CO₂ storage tanks are required.

As vessels become larger and lighter, the steel intensity of ship’s tonnage will fall. Steel intensity is expected to decline due to larger and lighter vessels.

Global Climate Action and Energy Transition

As a response to global warming, renewable energy is increasingly in demand. In fact, it is no longer being referred to as “alternative” energy but “mainstream”. The International Energy Agency (IEA) has predicted that the share of renewables within global power generation is expected to rise from 23 percent in 2014 to 37 percent by 2040.

The renewable energy sector is also adopting various types of steel products. The tube tower, which accounts for 65% of the weight of a wind turbine, is made mainly of steel, while thin stainless steel sheets and frames are required for solar panels. This wide application of steel products offers additional business opportunities to steel companies.

Meanwhile, the share of fossil fuels within primary energy consumption will fall from 81 percent to 74 percent over this span. However, the decline will be gradual due to population and economic growth in emerging countries and fossil fuels will continue to play a dominant role in the energy sector in terms of quantity of consumption.

Steel companies must target new markets by developing innovative steel products for the microgrids and energy storage systems which will grow alongside renewable energy.

The Steel Industry Over the Next Two Decades

Over the next two decades, the steel industry will face the following four challenges: slowing steel demand due to decreased steel intensity across major steel-consuming industries; a need for more advanced steel products; upgrading to eco-friendly and smart steelmaking processes; and changes in manufacturing based on the Fourth Industrial Revolution.

Accordingly, it is imperative that the steel industry boost its capabilities for continues product and process innovation and build a sound steel ecosystem through partnerships with steel-consuming industries.

To this end, POSCO is not only investing in the development of an eco-friendly rolling process but also in sustainable development including energy conservation and recycling technologies. In addition to factory automation based on IoT, big data and AI, POSCO is working to increase the application of smart technology internally as well as externally with its partners and affiliates.

It is an exciting time for the steel industry as it continues to transform along with the ongoing and emerging megatrends.

Download the full version of POSRI’s Asian Steel Watch journal for more at POSRI’s official website.

Don’t miss any of the exciting stories from The Steel Wire – subscribe via email today.

- asian steel trends

- Asian Steel Watch

- automobile

- car

- construction

- development

- energy

- energy sector

- Fourth Industrial Revolution

- future

- global

- global climate action

- globalization

- industrialization

- megatrends

- motorization

- POSRI

- POSRI asian steel watch

- posri report

- shipbuilding

- smart technology

- steel industry

- steel industry trends

- steel mega trends

- steel production

- steel products

- steel trends

- trends

- urbanization