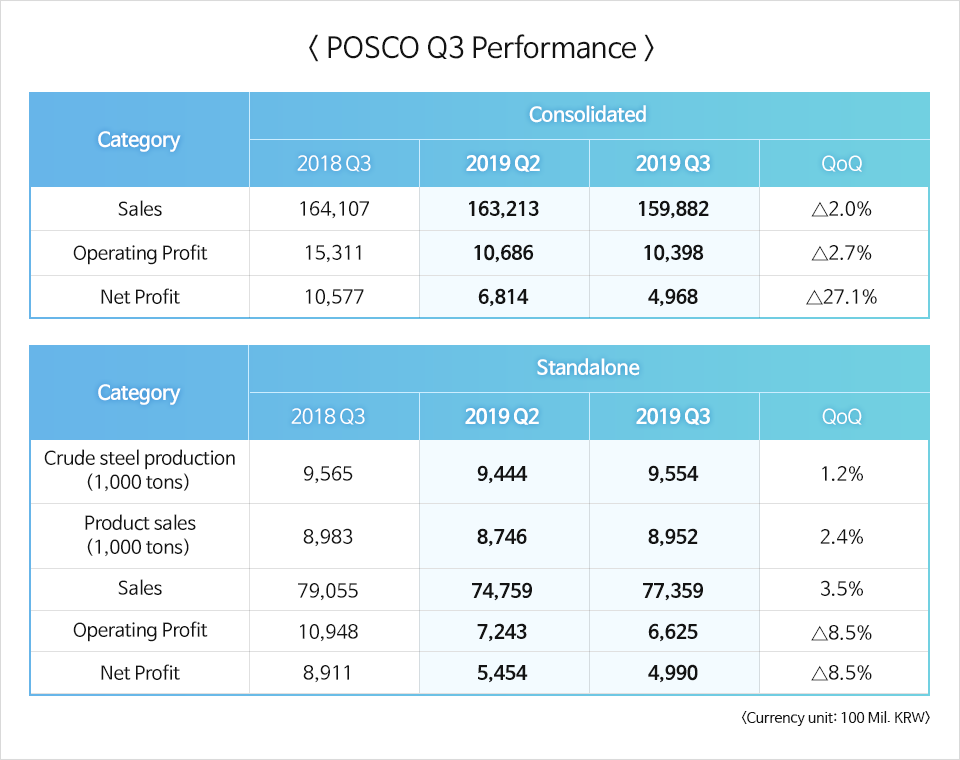

l Consolidated sales at 15.9882 trillion KRW; operating profit – 1.0398 trillion

l Standalone sales at 7.7359 trillion KRW; operating profit – 662.5 billion

l WTP sales ratio at a record 29.9%; solid performance in global infrastructure continues

POSCO’s operating profit surpassed one trillion KRW (854.34 million USD) on a consolidated basis – for nine consecutive quarters.

On Oct 24 (09:00 KST), POSCO reported its operating profit on a consolidated basis in its regulatory filing. The company’s Q3 sales totaled 15.9882 trillion KRW with 1.0398 in operating profit. The net profit was 496.8 billion.

As for POSCO’s steel business, the QoQ operating profit saw an overall decline, yet the improved performance by POSCO INTERNATIONAL in global infrastructure – the solid sales record from Myanmar gas fields and profit increase in trading – led to 6.5% in operating margins surpassing one trillion KRW operating profits for nine quarters straight.

POSCO’s standalone financial statements showed an operating profit of 662.5 billion KRW and a net profit of 499 billion. Q3 sales reached 7.7359 trillion.

The production line repair undertaken during Q2 is now complete, which boosted the overall sales volumes this quarter. Despite the increase in sales, production cost hike led to the overall decline of the operating profit QoQ – 8.5% down from the previous quarter. Meanwhile, the sales of POSCO’s high-value product, World Top Premium (WTP) recorded 29.9%, up by 0.3% point from the previous quarter – which minimized a further drop in operating profits. POSCO’s Q3 operating profit rate stood at 8.6%.

Due to the issuance of the company bonds, the amount of debt saw a slight increase, however, POSCO’s overall financial structure was stable with the consolidated debt-to-equity ratio at 65.7%.

Meanwhile, the orders from Korea’s major demand industries such as auto and construction are likely to slump, the company anticipates. The demand from developed nations remains stagnant, but POSCO expects moderate growth in global steel demand – China’s infrastructure, property market expenditures, and tax cuts will keep the steel demand solid, the company predicted.