POSCO (NYSE: , PKX) held IR conference call on October 23rd, to announce its 3Q performance results.

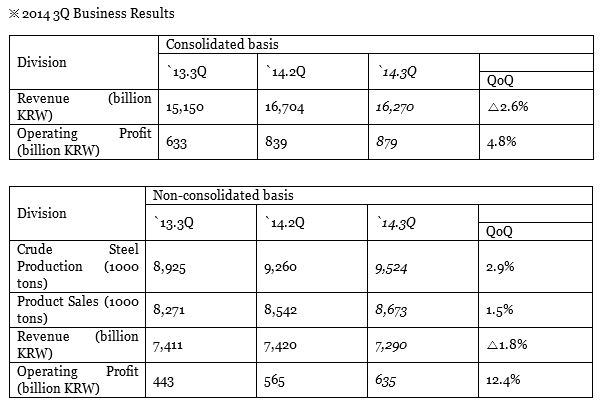

On a consolidated basis, the company recorded 16,270 billion KRW (About 14.4 billion USD) in revenue and 879 billion KRW in operating profit. Operating profit margin went up to 5.4%, 0.4%pt increase from 2Q, due to stabilization of global steel business and increased profit in the energy sector.

Especially, Indonesian integrated mi started operation from January 2014, showed utilization rate of 82% and 24% increase in sales volume from the 2Q, which resulted in 3Q operating profit. Also, POSCO India’s electrical steel mill turned the profit through expanding its sales base. With support from the stabilized performance of overseas steel mills, steel sector profitability recorded 5.3%.

Meanwhile, Daewoo International’s Myanmar gas field showed 20% of an increase in operating profit from 2Q, as production expanded as scheduled. Along with the increase in production volume, the operating profit of POSCO Energy has also increased by 138% from 2Q.

POSCO stand-alone revenue reached 7,290 billion KRW (7.2901 trillion USD) and operating profit recorded 635 billion KRW. Due to increased export to overseas production centers, POSCO’s product sales and operating profit have enhanced. As a result, POSCO has recorded operating profit of 8.7%, which is 1.1%pt increase from 2Q.

POSCO is also expanding its automotive steel products sale, by using global production sites and sales network. As POSCO continues to expand sales to global automakers towards target regions, including the U.S. and China, through 5 automotive steel product mills, and 47 coil centers, POSCO expects to reach 8.2 million ton in total sales amount of automotive steel in 2014.

POSCO’s client-oriented solution marketing activities have contributed to the increase in a high-value steel product sales. Adding to the development of high-strength PosM Steel, super austenitic stainless steel products and magnesium panel, the new automotive lightweight material, the sales of the solution marketing products have increased up to 407 thousand tons, which is 59% increase from 2Q.

Although the steel demand in 4Q is expected to increase slightly, due to seasonality and the slow market conditions of the automobile industry, POSCO plans to steadily expand the client-oriented solution marketing activities.

Moreover, POSCO has continued to reduce carbon emissions through activities, such as building off-gas power plants. Furthermore, POSCO will continue its social contribution to reducing greenhouse gases by development and sales of high strength steel for a lighter-weight automobile.