The latest issue of POSCO Research Institute’s Asian Steel Watch journal focuses on “the Fourth Wave of Manufacturing”, which broadly refers to the integration of industry with technology. This phenomenon applies to changes occurring in the steel industry, including the digitization of traditional business practices.

In the journal’s last installment of a special four-part series on Industry 4.0, Dr. Kyeongchan Kim, POSCO’s Vice President of Corporate Strategy Development, delves into the impact of e-commerce in China’s steel industry.

China’s Industry 4.0

When the “dot-com” frenzy took over the world in the late 1990s, the first steel e-commerce boom began, with major steel-producing countries such as the USA, Japan, European-countries and Korea leading the trend.

However, this wave was short-lived. Transactions reflected inadequacies between online and offline steel trade, and entry barriers were raised for traditional distributors.

Fast forward ten years later, and a second steel e-commerce boom begins in China. The rapid growth in China’s steel e-commerce can be attributed to three factors: the receptive landscape of the country’s steel trading market due to an industry slump; the “Internet Plus” and the “Made in China 2025” policies; and a growing desire for online expansion across the industry.

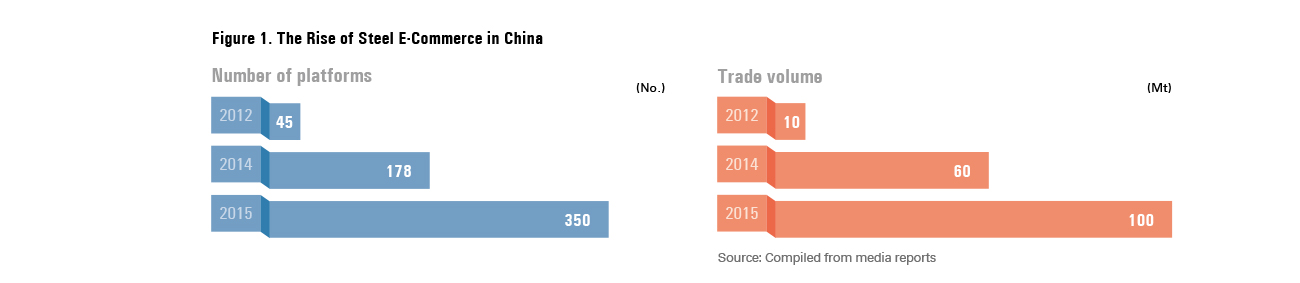

In 2015, the number of participating platforms in steel e-commerce in China and trade volumes have almost doubled from 2014’s statistics, characterizing the exponential rise in online steel sales.

E-Commerce Boom

Unlike other major steel producing countries, however, experts are claiming that China’s market has distinctive features that differentiate it from being a passing fad, like the previous boom.

Profitability has been a major concern for Chinese steelmakers, as the number of steel manufacturers and distributors has grown independently, creating fierce competition and adding to the country’s oversupply of steel.

Therefore, many companies have turned to e-commerce to increase their clout, while distributors, venture capitalists and information consultants have utilized this strategy to reinforce their footholds in the market and pursue new business opportunities.

Currently, there are five steel firms in China that account for 90% of the total steel e-commerce trade: Zhaogang, Banksteel, Opsteel, Xinyilian and Ouyeel.

Future Sales Overseas

In the future, it is predicted that China’s steel e-commerce market will be led by a few firms, which will eventually restructure the overall steel industry in China. Oversupply will be gradually reduced, fledgling and floundering businesses will close and the economy will stabilize.

The Chinese government is an influential presence in this restructuring, and aims to increase the total steel trade through e-commerce by about 20%, or 150-200 million tons.

Currently, most of China’s steel e-commerce firms are trying to shift the model of inventory sales to order sales to expand the implementation of the “Made in China 2025” and “Internet Plus” policies, upgrading their general steel products to those of higher quality.

To broaden their sales channels, major Chinese steel e-commerce companies are branching out to export in other countries, such as Korea, Vietnam, Thailand and Dubai.

Steady Climb in Emerging Markets

If China’s Industry 4.0-style policies do take hold in the steel industry, its steel e-commerce will most likely be more than just a fad. The size of the market, business opportunities and profitability especially reflect this trend’s direction.

By first focusing on becoming the main distribution channel for general steel products domestically, China’s e-commerce firms will incrementally take hold of overseas markets, particularly emerging ones.

Chinese platforms understand that steel e-commerce will not spread as quickly abroad as it did in their own country, and will seek gradual expansion through traditional and digital business integration.