Shipbuilding industries have a massive impact on both upstream industries, e.g., shipping, and downstream industries like machinery, steel, and electronics industries. Since shipbuilding requires a vast amount of steel and various machinery, demand for steel is high amongst shipbuilders, just like with automakers and construction sectors.

The operation of the shipbuilding industry is intrinsically linked to that of steelmakers like POSCO which is why the company is keeping a close watch on the latest news that affects the fate of shipbuilders.

l After Hitting Rock Bottom, Ship Orders Go Up

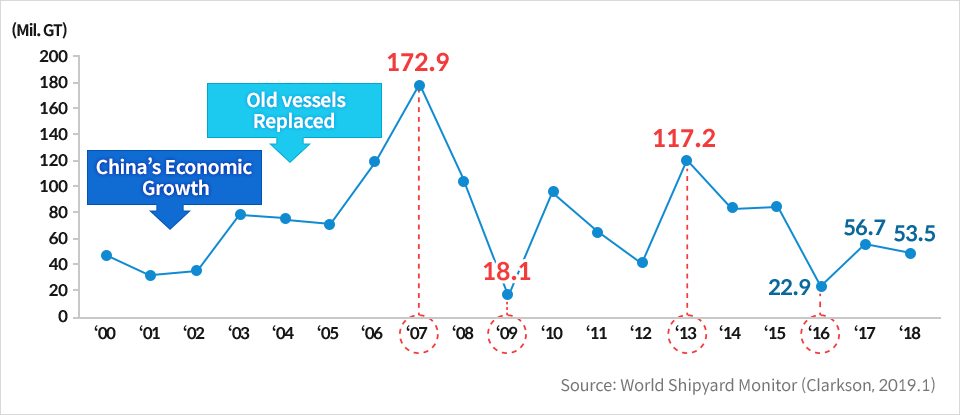

In the mid to late 2000s, the shipbuilding industry enjoyed unprecedented prosperity due to multiple factors: one of which was China’s economic growth. The other reason had to do with increased ship orders – old vessels had to be replaced. In 2007, the ship orders worldwide peaked at 173 million GT (Gross Tonnage: a nonlinear measure of a ship’s overall internal volume).

Since 2007, however, the orders saw a sharp decline, and a long-term depression followed. Global orders in 2009 decreased by 90% compared to the peak year in 2007. With 117 million GT, the orders briefly went up, but quickly declined again in 2014. In 2016, the total orders were at only 23 million GT.

After hitting rock bottom in 2016, the orders are slowly increasing, reaching 57 million GT in 2017 and 54 million in 2018. With this slight upward trend, a new prediction is surfacing: that perhaps the end of the recession is in sight for shipbuilders. What is the basis for such prediction?

<Annual Ship Orders Worldwide>

If the shipbuilding industry were to recover, conditions that necessitate new ship orders should precede. The peak in 2007 was due to the economic boom in China which led to a rapid increase in raw material imports. Exports of manufactured products also shot up. Following the overall increase in trade volumes, global marine traffic increased significantly.

Such an increase in overall marine traffic necessitated new vessels, which accounted for the record-high number of orders in 2007. However, China’s economic growth is slowing down with no countries to fulfill China’s void.

Many identify India as the next China, but India has yet to show the same growth curve as China had. The scale of emerging economies of Southeast Asia, e.g., Vietnam and Indonesia, are considerably minuscule when compared to China. As such, the potential for large-scale orders like those of 2007 is low.

l New IMO Regulations to Guide the Recovery of Shipbuilding Industry

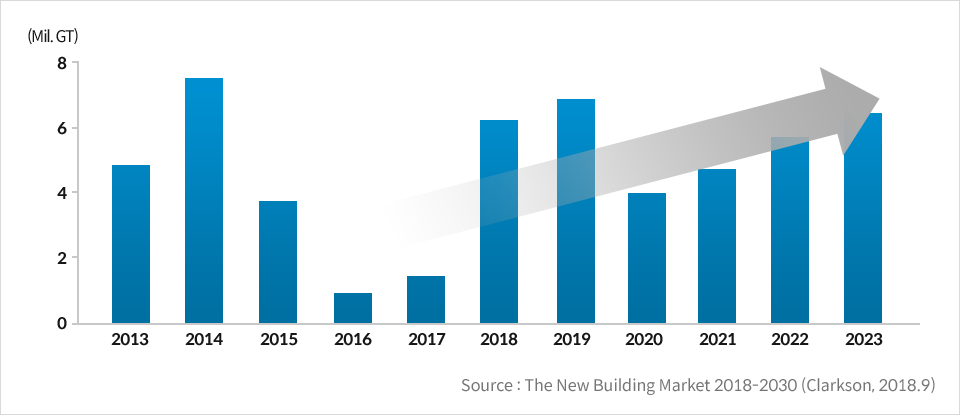

In recent years, however, environmental concern is escalating worldwide and the regulations to protect the globe is becoming more rigid. Such changes are expected to bring positive impacts on the shipbuilding industry. Clean energy requirement is boosting the demands for clean fuels like LNG, which is likely to result in more orders for LNG.

The below graph shows a sharp increase in orders for LNG carriers, and the upward trend is likely to continue.

<LNG carrier order prospects>

Furthermore, the International Maritime Organization (IMO) will implement strengthened emission standards for ship pollutants. The new regulation requires vessels to lower the upper limit of sulfur oxides emissions from 3.5% to 0.5%.

To fulfill the new standard, shippers can use low sulfur fuel or install desulfurization device like scrubbers in existing ships. LNG-powered vessels are also an option.

With low-sulfur oil, companies can keep the existing vessels with no modification, but the price of the fuel is high, and it can also adversely affect the engine. Installing a scrubber can be costly, which will also incur modifying the existing vessels.

Therefore, existing vessels may use low-sulfur oil or scrubbers, but new ships are likely to opt for LNG-powered carriers. As for POSCO, the company chose to attach desulfurization device to their current vessels for raw materials transportation, as per the new IMO regulations.

The changes in global environmental standards might not be a gamechanger in dramatically boosting the economy nationwide. Still, it is a positive signal for the shipbuilding industry.

l Korea Takes the Upper Hand for LNG-Carriers and VLCC

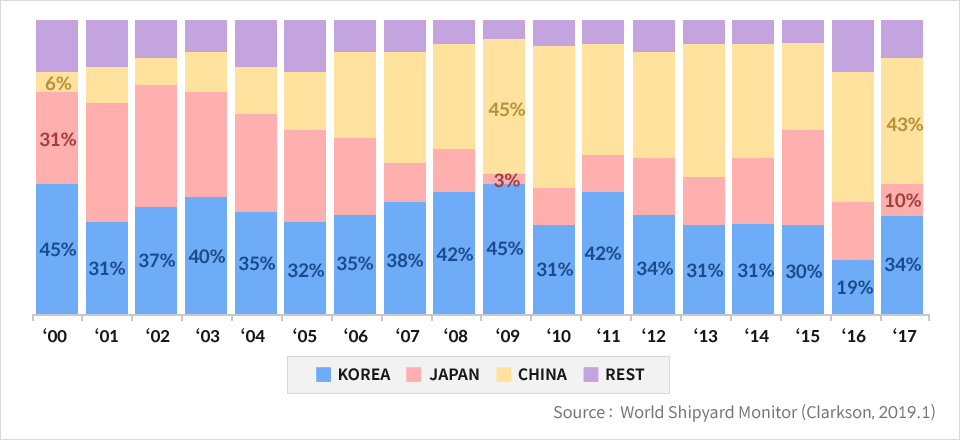

In the past, it used to be that Korea and Japan accounted for nearly 80% of total orders, but now it’s Korea and China instead. The below graph shows that Korea secured a minimum of 35% of total orders regardless of economic condition – recession or boom. Furthermore, demand for LNG carriers has increased significantly in recent years. As of this January, Korea takes up about 11 million GT of the total global orderbook for LNG carriers which is 14 million GT – this means Korea is holding 80% of the entire orderbook.

*Orderbook: number of orders (in this case, ships) to be built

<Order Quantity by Countries>

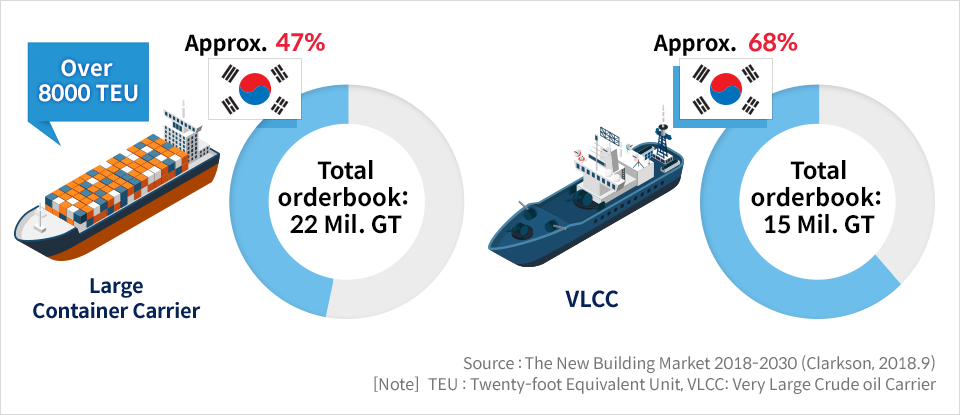

Another trend in the shipbuilding industry in recent years is the scale of the vessels. It’s vast – orders for container carriers with a capacity of over 20,000 containers or large carriers that transport over 200,000 cubic meters of LNG at one time are also increasing.

For large vessels over 8,000 TEU (TEU: Twenty-foot Equivalent Unit), Korea accounts for approximately 47% of the total orderbook of 22 million GT. As for the VLCC (Very Large Crude-Oil Carrier), Korea accounts for nearly 68% of the orderbook of 15 million GT, demonstrating Korea is highly competitive with large vessels. Korea’s strength comes from several decades of experience of building thousands of ships.

Despite the 6% decline in global order volume in 2018, Korea’s YoY order increased by 26%, which demonstrates Korea has the upper hand when it comes to securing global contracts.

<Korea’s Orderbook for Large Vessels>

l POSCO Technology Boosts Korea’s Competitiveness

It takes years to achieve a high level of skills and experience. The gap in knowledge and technology is hard to reverse in the short term. According to an analysis by KIET (Korea Institute for Industrial Economic & Trade), the shipbuilding technology gap between Korea and China is about 5.2 years. However, just as Korea has overtaken Japan’s technology in the past, China could follow suit. No one can predict how long Korea’s competitiveness might last.

As the operations of shipbuilding and the steel industry are closely linked to each other, one can help enhance the capacity of the other, and vice versa, to either maintain the current gap or expand the gap with China.

In that sense, POSCO’s high manganese steel has enormous potential. The LNG storage tank in the LNG carrier and the fuel tank of the LNG propulsion ship should be made of a material that can withstand a cryogenic temperature lower than minus 170 degrees Celsius, to store liquefied natural gas.

Currently, stainless steel and 9% nickel steel are used as core materials. However, POSCO recently developed a high manganese steel with a manganese content of 22.5% ~ 25.5%. High Manganese steel (hereafter HMS) can withstand temperatures of minus 196 degrees Celsius and comes with high tensile strength and lower cost. For years, POSCO has made efforts so the HMS so the IMO can list the HMS as a standard base material for LNG tanks. Last year, POSCO’s HMS finally received IMO approval (Refer to POSCO’s High Manganese Steel To Go Global).

With such material, South Korea will potentially take the upper hand over Japan and China in terms of price competitiveness for LNG-related vessels. If more ship orders can be secured with POSCO’s steel products, and demands for steel materials increase, it is likely to be a potential win-win situation for both industries.