Recently, POSCO Holdings announced a large-scale lithium investment plan as a core strategy to realize its vision of “Materials for the Nation,” laying a critical foundation for its ambition to emerge as a global lithium player. The investments target equity stakes in lithium mines in Australia and mining rights to the Hombre Muerto salt lake in Argentina, enabling POSCO Holdings to secure stable lithium production capacity while strengthening its global competitiveness. In this article, we take an in-depth look at the strategic significance of these investments and POSCO Group’s long-term lithium business outlook, together with Senior Research Fellow Jae-bum Park of the POSCO Research Institute.

Q. Could you explain the key details of the recent equity investment in Australian lithium mines and the additional acquisition of mining rights to a salt lake in Argentina, as well as the background behind these investments?

Lithium is currently the most widely used material in electric vehicle batteries, yet its strategic value continues to rise rapidly. Beyond electric vehicles, lithium-based batteries are increasingly essential across a wide range of industries, including artificial intelligence, drones, next-generation aircraft, and space exploration. They also play a critical role in Energy Storage Systems (ESS), which store electricity generated from renewable energy sources such as solar and wind power. As demand continues to expand across these sectors, global efforts to develop faster and more efficient next-generation batteries are accelerating. Once commercialized, these advanced batteries are expected to drive a significant increase in lithium demand beyond current levels. In this context, lithium has firmly established itself as one of the most closely watched and strategically important raw materials worldwide.

Against this backdrop, POSCO Holdings, following extensive deliberation, decided to move forward with a large-scale lithium investment to strengthen its competitiveness in future advanced materials businesses. The initiative comprises two key pillars: an equity investment in lithium mines in Australia and the acquisition of mining rights to the Hombre Muerto salt lake in Argentina. These investments reflect POSCO Holdings’ strong commitment to securing a stable supply of high-quality lithium resources and positioning itself as a global lithium company.

Q. What are the resource characteristics and competitive strengths of the two Australian lithium mines in which POSCO Holdings has invested?

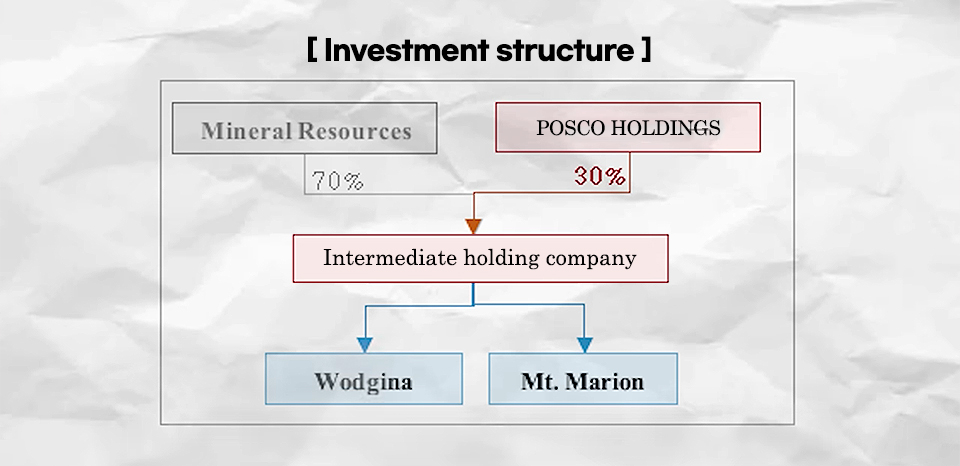

Globally, only around ten lithium mines are classified as Tier-1, a designation reserved for assets with exceptionally high ore grades. Most of these are concentrated in Western Australia. POSCO Holdings plans to acquire equity stakes in two such Tier-1 assets: the Wodgina mine and the Mt Marion mine.

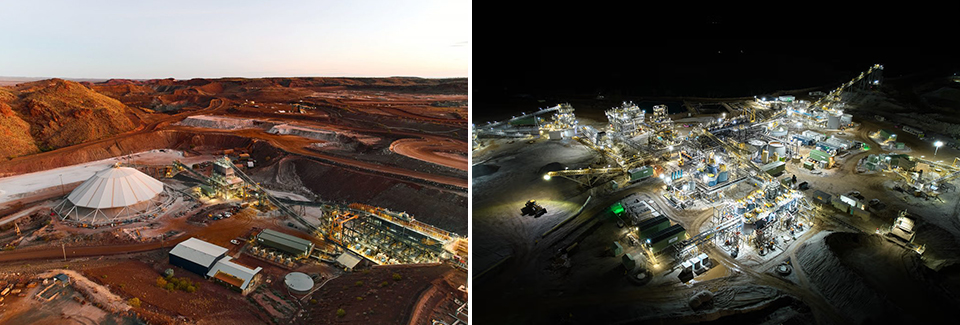

▲ POSCO Holdings, through a joint venture intermediate holding company established with Australia’s Mineral Resources, holds a 30% stake in the Wodgina mine (left) and the Mt. Marion mine (right). (Right photo source: Mineral Resources website)

The Wodgina mine has officially confirmed reserves of approximately 6.5 million tonnes of lithium carbonate equivalent (LCE)*, the standard reference form for lithium used in battery materials. Lithium at Wodgina is produced in the form of spodumene concentrate, which undergoes beneficiation to increase lithium content. With spodumene grades reaching approximately 5.5%, the Wodgina mine is widely regarded as a top-tier lithium asset. The Mt Marion mine likewise holds around 2.1 million tonnes of LCE in reserves, with spodumene concentrate grades approaching 5%, and is therefore also recognized as a high-quality lithium resource.

*LCE (Lithium Carbonate Equivalent): a standardized measure expressing lithium content in terms of lithium carbonate.

Currently, Mineral Resources holds a 50% stake in each mine. POSCO Holdings plans to establish a jointly owned intermediate holding company with Mineral Resources and invest approximately USD 765 million (around KRW 1 trillion) to acquire a 30% stake in the holding company.

Q. What business benefits does POSCO Holdings expect to gain from its equity investment in Australian lithium mines?

By securing equity stakes in the Wodgina and Mt Marion mines, POSCO Holdings expects to stably secure approximately 270,000 tonnes of lithium concentrate per year, reflecting planned production capacity expansions at both sites. This volume is sufficient to produce around 37,000 tonnes of lithium hydroxide—enough to supply batteries for approximately 860,000 electric vehicles. Both mines are capable of producing spodumene concentrate, meaning the investment is expected to generate revenue not only through concentrate sales, but also by securing a stable supply via long-term offtake agreements.

In hard-rock lithium operations, raw material costs account for a substantial portion of total production costs, making integration between mining and downstream processing a critical determinant of cost competitiveness. Even with optimized production processes, there are inherent limits to reducing raw material costs. Accordingly, this investment provides a strategic foundation for generating raw material sales revenue, mitigating exposure to price volatility, and improving overall operational efficiency across the value chain.

Q. How does the newly acquired salt lake mining right in Argentina differ from the salt lake assets POSCO Holdings already holds?

In addition to its Australian mine investments, POSCO Holdings plans to acquire additional mining rights at the Hombre Muerto salt lake in Argentina. In 2018, the company already secured mining rights covering approximately 25,000 hectares in the northern portion of the salt lake, which spans a total area of roughly 60,000 hectares. Hombre Muerto is widely regarded as one of the world’s highest-quality brine resources, characterized by high lithium concentrations and low impurity levels. In light of expectations for rapidly rising global lithium demand, POSCO Holdings decided to pursue the additional acquisition.

The newly acquired area is adjacent to POSCO Holdings’ lithium processing plant currently under construction. The mining rights are held by NRG Metal, the Argentine subsidiary of Canadian company Lithium South. POSCO Holdings plans to acquire a 100% stake for approximately KRW 100 billion, enabling operational synergies with its existing salt lake assets.

Q. How is the additional acquisition of salt lake mining rights expected to affect POSCO Holdings’ lithium supply chain and competitiveness?

The newly acquired salt lake asset is estimated to contain approximately 1.58 million tonnes of LCE, with an average lithium concentration of 736 mg/L, and is considered a premium brine resource due to its low impurity levels. Because the asset is located within the same Hombre Muerto salt lake already operated by POSCO Holdings, the brine composition is highly similar. This allows the company to leverage existing extraction processes, local infrastructure, and operational experience, creating favorable conditions for producing lithium at a competitive cost.

In parallel, POSCO Holdings is developing Direct Lithium Extraction (DLE) technology, moving away from the conventional evaporation pond method that requires several years. DLE offers shorter processing times, higher recovery rates, reduced land requirements, and lower water and environmental impact, making it a promising next-generation lithium extraction technology. With the additional mining rights secured, POSCO Holdings will be able to expand its lithium carbonate production infrastructure. Once DLE technology is fully validated and commercialized, the company expects to achieve more economical and efficient lithium production.

▲Ombre Muerto lithium salt lake, Argentina.

Q. Recently, POSCO Group has been strengthening supply chain cooperation with Australia to enhance its global competitiveness in critical minerals. What projects are currently underway?

POSCO Group has established a foundation to produce lithium hydroxide domestically starting in 2024 by securing a supply of spodumene mined in Australia. This strengthened cooperation has expanded into equity investments in Australian lithium mines and broader collaboration with leading Australian research institutions, reinforcing R&D capabilities in critical minerals such as lithium and rare earth elements.

▲ POSCO Holdings signed an MOU with the Australian Nuclear Science and Technology Organisation (ANSTO) on November 19 for critical minerals technology development. From left: Ki-soo Kim, POSCO Group CTO, and Oleh Nakone, Group Executive at ANSTO.

In May, POSCO Holdings became the first Korean company to establish a dedicated overseas resource research hub with the launch of the Australia Critical Minerals R&D Lab. In November, it signed an MOU with the Australian Nuclear Science and Technology Organisation (ANSTO), Australia’s leading government-affiliated research institute and a central hub for critical minerals R&D. Through this partnership, the two organizations plan to pursue joint research projects in refining technologies and advanced material characterization, while holding regular technical exchange forums to strengthen global technological competitiveness.

Q. How is this large-scale investment expected to reshape POSCO Group’s long-term lithium strategy and the global competitive landscape?

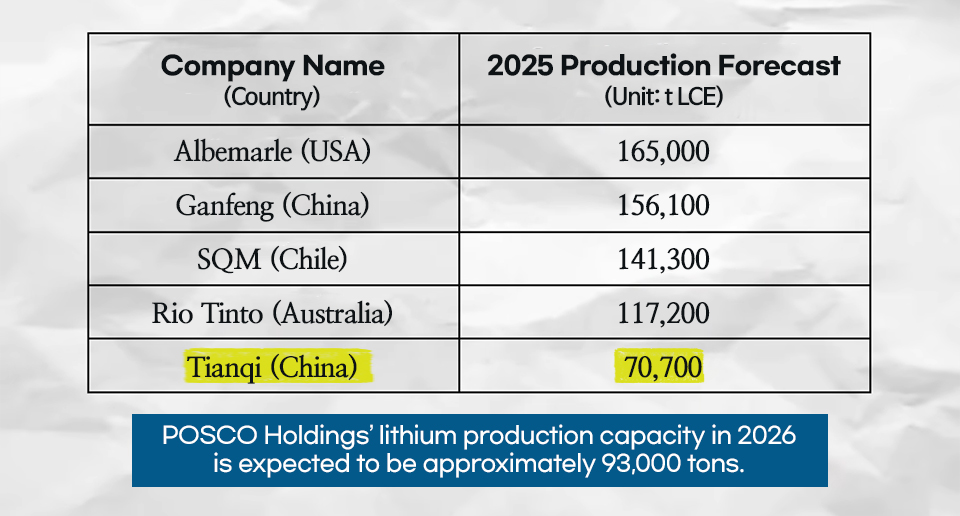

By securing premium lithium resources, POSCO Group is establishing a stable supply base that will enable it to compete with top-tier global lithium producers over the long term. Worldwide, 65 companies are preparing for lithium production. Based on projected 2025 output, the top five producers are Albemarle, Ganfeng Lithium, SQM, Rio Tinto, and Tianqi Lithium.

Their primary competitive advantage lies in ownership of large-scale, high-grade lithium resources. Through this investment, POSCO Holdings is expected to secure annual lithium production capacity of approximately 93,000 tonnes by 2026—exceeding the roughly 70,000 tonnes produced by Tianqi, currently ranked fifth globally. Once ramp-up is complete and production stabilizes, POSCO Group has a strong chance of entering the global top 10 lithium producers.

By securing both spodumene from hard-rock mines and lithium from salt lakes, POSCO Holdings is also well positioned to expand refining capacity as market demand grows. This allows consideration of investments not only in lithium hydroxide, but also lithium carbonate, reducing supply-demand risks while diversifying the supply chain. Going forward, POSCO Group will continue to closely monitor lithium market conditions and policy developments, adjusting investment scale and timing with flexibility.

The recent Australian mine investments and the additional acquisition of salt lake mining rights in Argentina clearly demonstrate that POSCO Holdings’ future growth strategy is progressing successfully—and that its blueprint for securing premium lithium resources is steadily being realized.