POSCO Holdings held the third Value Day of POSCO Group’s Rechargeable Battery Material Business at the POSCO Center on July 12 to introduce the strategic direction for improving the group’s corporate value, including the retirement of treasury stocks worth approximately KRW 2 trillion and the strategy for upgrading the rechargeable battery material business. We will visit the Value Day event, which excited the participants with the goal of increasing corporate value with a strong shareholder return policy and achieving group sales of KRW 11 trillion in the rechargeable battery materials business by 2026.

POSCO Group to open the door for communication with stakeholders

The annual Value Day of POSCO Group’s Rechargeable Battery Material Business is part of an IR campaign where management directly explains and communicates the business vision and strategy to investors and security industry analysts. The event has been well received since its inception, as it goes beyond a simple presentation of information and reinforces mutual trust through direct communication with investors.

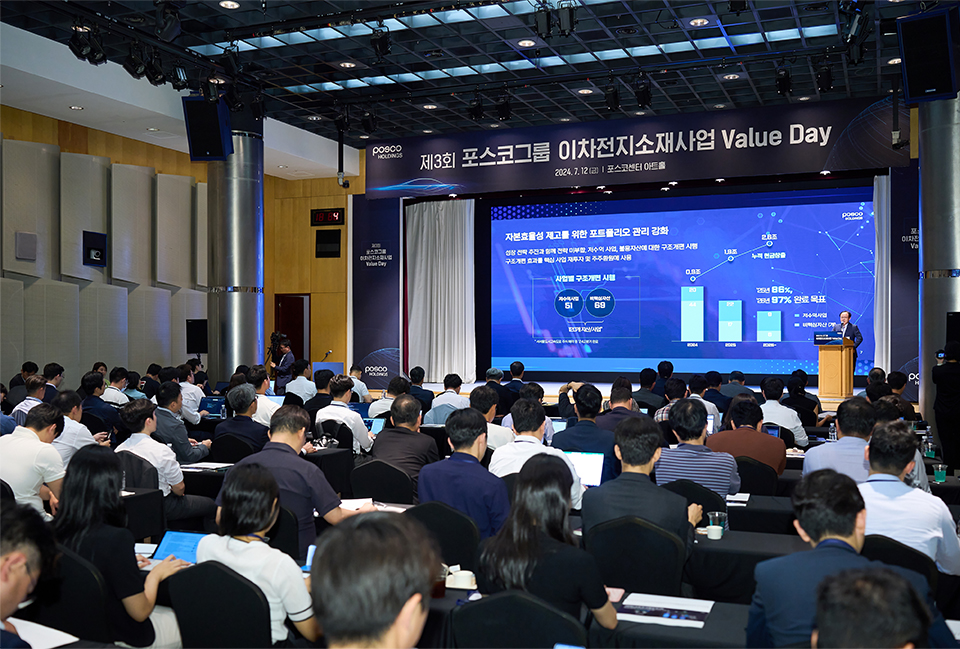

▲About 200 domestic and international investors and analysts attended the ‘3rd POSCO Group Rechargeable Battery Materials Business Value Day’ held on July 12.

In its third anniversary this year, the Value Day was attended by POSCO Holdings’ head of strategic planning CSO, CEO, and President Jeong Gi-seop, head of Rechargeable Battery Materials Vice President Kim Jun-hyeong, and the head of LiB Materials R&D Laboratories Hong Yeong-jun, and about 200 domestic and foreign institutional investors and security analysts visited the event. Despite the poor rechargeable battery materials business this year due to unfavorable market conditions, the excitement at the event venue was as high as last year when business was booming.

The event was organized into two parts: presentations by executives on topics such as POSCO Group’s new management vision, strategic direction for improving corporate value, and strategy to upgrade the rechargeable battery materials business in a downturn situation in Part 1 and a Q&A session where the participants and business managers directly asked and answered questions in Part 2.

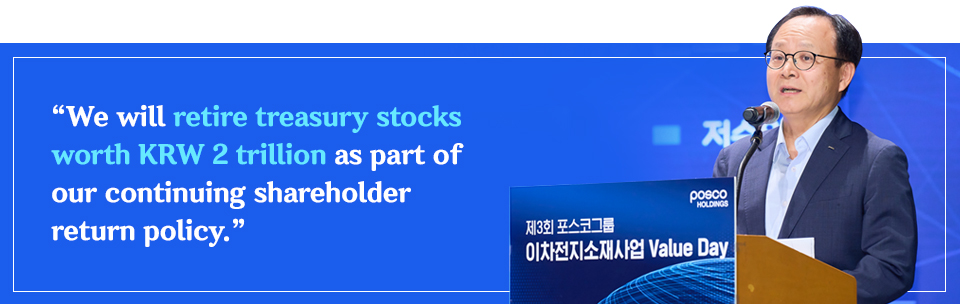

▲Jeong Gi-seop, Head of Strategy Planning (CEO and President), is announcing the ‘Strategy Direction for Enhancing Corporate Value.’

The first part included a welcoming speech by CEO and President Jeong Gi-seop, followed by a presentation on POSCO Group’s strategy for its rechargeable battery materials business and technology strategy for next-generation battery materials. “POSCO Group has achieved remarkable results in the steel industry,” CEO Jeong said in his speech, adding, “We will not be satisfied with this achievement but will focus the group’s resources and capabilities on the rechargeable battery material business along with steel.” He went on to say, “We will continue a strong shareholder return policy, including growth investment and restructuring of low-yield assets as well as the retirement of all treasury stocks excluding convertible bond deposits over the next three years to improve capital efficiency.”

▲Attendees of the 3rd POSCO Group Rechargeable Battery Materials Business Value Day applaud after hearing the welcoming speech.

In the steel business sector, POSCO Group plans to prepare a global growth roadmap centered on the upstream process in India and the United States and improve asset management efficiency by restructuring low-return assets. Moreover, POSCO Group declared its goal to proactively use the downturn period to ensure competitiveness by procuring outstanding resources, dominating the next-generation battery materials market, and growing into a global top-tier materials company.

“We have finalized 120 restructuring plans, including those that do not match our strategy, low-profit businesses, and unused assets to improve capital efficiency,” CEO Jeong Gi-seop said. POSCO Group expects to raise approximately KRW 2.6 trillion in cash by quickly implementing more than 97% of its restructuring targets by 2026 and plans to use the cash to reinvest in core businesses for growth and return to shareholders.

POSCO Holdings also plans to continue its shareholder return policy. Of the 10% of treasury stocks it currently holds, it plans to retire 6%, worth about KRW 1.9 trillion, excluding the 4% mandatory deposit required for the issuance of convertible bonds, by 2026. In addition, the Board of Directors decided to purchase and retire KRW 100 billion worth of treasury stocks immediately. Moreover, to increase shareholder value in the future, POSCO Holdings announced a basic policy of immediately retiring all newly acquired treasury stocks except for use by employees and promised to repay the support of shareholders.

Lastly, CEO Jeong said, “We will increase corporate value by improving capital efficiency through growth investment, adjustment of low-performing assets, and strengthening shareholder returns,” and added, “We ask for your interest and encouragement in POSCO Holdings’ efforts to grow into a top-tier company.”

Vice President Kim Jun-hyeong of POSCO Holdings’ Rechargeable Battery Materials Business took the podium next and presented the company’s “strategy to advance the rechargeable battery materials business.” “The EV market is in the middle of a downturn period and is experiencing a slowdown in growth rate,” VP Kim said and explained the market situations in major countries. He added, “To break through the slump, POSCO Group will achieve group sales of approximately KRW 11 trillion in the rechargeable battery materials business by 2026 by completing the full value chain, strengthening business competitiveness, and dominating the next-generation battery materials market.”

This is the first year for POSCO Group to operate the full-scale rechargeable battery material supply system, and the company plans to provide customized integrated solutions to each customer by completing the full value chain. Moreover, it will apply its know-how of being No. 1 in global competitiveness in the steel business to the rechargeable battery materials business to improve its operational and competitiveness and accelerate growth by creating synergy through industry-academia-research cooperation with POSCO Future M, POSTECH, and POSCO N.EX.T Hub.

VP Kim also announced the strategy to “strengthen our business competitiveness and use the current downturn period as an opportunity to secure outstanding lithium resources such as salt lakes and mines and produce IRA-qualified nickel products with smelting and refining in Korea.” POSCO Group plans to secure a stable customer base, diversify its product portfolio in the cathode materials sector, and strengthen its full lineup of anode materials, including natural and artificial graphite and silicon, as the world’s only IRA-qualified, non-FEOC (Foreign Entity of Concern) producer in the anode materials sector. Moreover, to dominate the next-generation materials market, POSCO Group plans to supply all three core components of all-solid-state batteries, anode materials, solid electrolytes, and lithium metal anode materials, in conjunction with the customers’ all-solid-state battery commercialization plans, he added.

▲Hong Yeong-jun, head of POSCO Holdings’ LiB Material R&D Laboratories (Vice President), is presenting trends at major customers and strategies to lower the cost of raw materials for battery materials.

Next, Hong Yeong-jun, head of POSCO Holdings’ LiB Materials R&D Laboratories, presented the current status of global rechargeable battery materials and next-generation battery development by automobile companies and the technology strategy for next-generation battery materials that POSCO Group is paying attention to. He began by identifying major customer trends during the downturn period and explained the strategy for lowering the prices of raw materials for battery materials by recycling. The participants were particularly focused on the presentation since the prices of raw materials for battery materials are a key competitiveness factor in the eco-friendly vehicle market. Some attendees showed high interest and expectations in the raw material cost reduction strategy by taking screenshots and notes of the presentation.

“We can expect a 3% cost reduction by additionally recalling lithium in byproducts and improving the proprietary process in lithium-conventional resources and direct lithium extraction (DLE) productivity by 15% in the short term and 130% in the mid to long term with the application of the technology to selectively absorb only lithium in lithium-non-conventional resources,” VP Hong said, and added, “We plan to commercialize all-solid-state batteries required in the future automobile market, focusing on sulfide-based batteries, by 2027. We will secure unique patents with advanced analysis and all-solid-state material mixing technology and strengthen our global competitiveness through joint development with major automobile and battery companies.”

Vice President Kim Jun-hyeong, head of POSCO Holdings’ Rechargeable Battery Materials Business; Vice President Hong Yeong-jun, head of POSCO Holdings’ LiB Materials R&D Laboratories; Lee Seong-won, head of Lithium Business, Lee Jae-yeong, head of Ni&Next-generation Business, and Hong Jeong-jin, head of the Energy and Materials Strategy Office, led the Q&A session with investors and analysts in Part 2. Han Yeong-a, the session moderator and managing director of the IR Team at POSCO Holdings, was kept busy with many participants raising their hands at the same time to ask questions. They asked various business-related questions, such as the lithium price forecast, sales contract forms and conditions, the commercialization of all-solid-state batteries, and the competitiveness of IRA-qualified nickel supply.

An analyst at Hana Securities asked about difficulties in preparing to secure unique patents related to the all-solid-state technology announced by VP Hong Yeong-jun. “It is true that there is a shortage of source-level patents in the global market. Although it will not be easy to surpass the patents of existing competitors, we should be able to acquire source-level patents and become globally competitive by considering other approaches,” VP Hong answered.

There were also questions about the mid- to long-term lithium price outlook, reflecting the current poor market conditions. “Some projects have been canceled as prices fall due to excess lithium supply. When the demand keeps increasing, the supply-demand balance will ultimately change. It is too early to tell, but we cautiously expect the price to rebound by 2028.”

The Q&A session ended well past the scheduled time due to continued questions from the participants. It confirmed that investors are very interested in the strategy and direction of POSCO Group’s rechargeable battery materials business. “It was very helpful to see POSCO’s core strategy and future vision to overcome difficult market conditions,” an analyst who attended Value Day said.

Q What is the goal of this year’s Value Day of POSCO Group’s Rechargeable Battery Material Business?The growth of the electric vehicle market has slowed, and rechargeable battery-related stocks are undergoing a significant correction. We had many concerns about holding Value Day in these difficult times, but we thought that keeping our promise to investors was the highest priority, so we did our best to prepare for the event again this year. Contrary to our worries, many people attended and we saw excitement from investors. Our goal was to inform and communicate with investors about the strategies that POSCO Group will use to overcome this difficult slump situation, and I am glad that the goal was achieved. Q What did you focus on in your preparation for this year compared to last year’s event?Last year, most plants were under construction, while this year, many have been completed and are in operation. We focused our preparation on what our investors were curious about, such as the production status after the completion of construction, the vision of the newly appointed POSCO Group management, and the growth strategy for the steel and rechargeable battery materials businesses. Although the market situation is difficult, it was an opportunity to answer questions about POSCO Group’s direction. Q How do you feel about successfully hosting this year’s event?The event’s Q&A session lasted for more than an hour, and the conversation was quite intensive as the top management directly answered the questions of investors and analysts. We tried to communicate POSCO’s strategy and vision honestly regardless of the market situation, and many investors supported us in the effort. Since POSCO Group’s Value Day is almost the only event in Korea for communicating directly with investors regarding the rechargeable battery materials business, we will continue to communicate closely with investors to increase corporate value.

Q What are your impressions of attending the third Value Day for POSCO Group’s Rechargeable Battery Materials Business?POSCO Group held an event to share its strategic direction with investors as always, even though the steel and rechargeable battery market is sluggish this year compared to last year. The introduction of the business status and future strategy was impressive. It was a glimpse of the management’s commitment to responding calmly to the sluggish market conditions compared to last year and using this year’s difficulties as an opportunity to strengthen the rechargeable battery materials business. Q Please briefly evaluate the strategy for the rechargeable battery material business direction presented at this event.To summarize the strategic direction for the rechargeable battery materials business as presented by POSCO Group at this event, it will use the current downturn as an opportunity to improve the company’s competitiveness and strengthen the choice and focus by distinguishing areas that require restructuring and growth throughout the company. POSCO Group has spent considerable time and effort in improving corporate value by balancing investment and shareholder return while maintaining the stability of its financial structure. Q What is your forecast for POSCO Group’s rechargeable battery materials business?The POSCO Group’s challenge in the rechargeable battery materials business is to create profits as the construction of the lithium and nickel refining plants nears completion. Profitability inevitably depends on market status, but we evaluate the competitiveness by checking the level of profitability it can generate compared to its competitors. It is a difficult situation, but it is expected that POSCO Holdings’ low net debt ratio, the full value chain of rechargeable battery materials formed throughout the group, and continuous efforts to improve competitiveness will pay off. |

Despite the difficult market situation, the third Value Day for POSCO Group’s Rechargeable Battery Materials business received great interest and support from many stakeholders. POSCO Group plans to further strengthen its business competitiveness to achieve the highest global corporate value in the materials sector by 2030.

We would like your support for POSCO Group’s actions as we grow into a global top-tier company in the rechargeable battery materials business by approaching the difficult downturn situation as a new opportunity.