Recently, as national policies have been strengthened to address the climate crisis and the transition to sustainable energy has been accelerating, the aviation industry is rapidly shifting from conventional fossil fuel-based jet fuel to sustainable aviation fuel (SAF). With Young-hoon Kim, Senior Research Fellow at the POSCO Research Institute (POSRI), we conduct an in-depth analysis of SAF as a new growth engine, changes in global market dynamics, and Korea’s strategic response as a leading jet-fuel exporter.

Senior Researcher Young-hoon Kim, POSCO Research Institute

Rapidly Expanding SAF Market

In the past, the automotive industry rose to the challenge of reducing its carbon footprint, resulting in the widespread presence of eco-friendly vehicles on today’s roads. Today, the aviation industry accounts for approximately 2-3% of global carbon emissions and, much like the automotive sector in the past, is now grappling with the challenge of reducing them. It is no exaggeration to say that the aviation sector’s sustainability increasingly hinges on SAF. SAF is a fuel developed to replace conventional jet fuel, produced from raw materials such as used cooking oil; vegetable and animal oils/fats; biomass; animal manure; waste wood; municipal solid waste; and captured carbon dioxide (CO2). It delivers performance equivalent to conventional jet fuel while reducing greenhouse-gas emissions from the production process by up to about 80%.

The first use of SAF in the aviation industry took place in 2008, but usage was negligible at the time. A major shift began in 2021, when the International Air Transport Association (IATA) adopted a resolution at its 77th Annual General Meeting to achieve net-zero carbon by 2050. Following this decision, the share of SAF in global jet fuel consumption rose steadily: 0.1% in 2022, 0.2% in 2023, and 0.3% in 2024, increasing by approximately 0.1 percentage points each year.

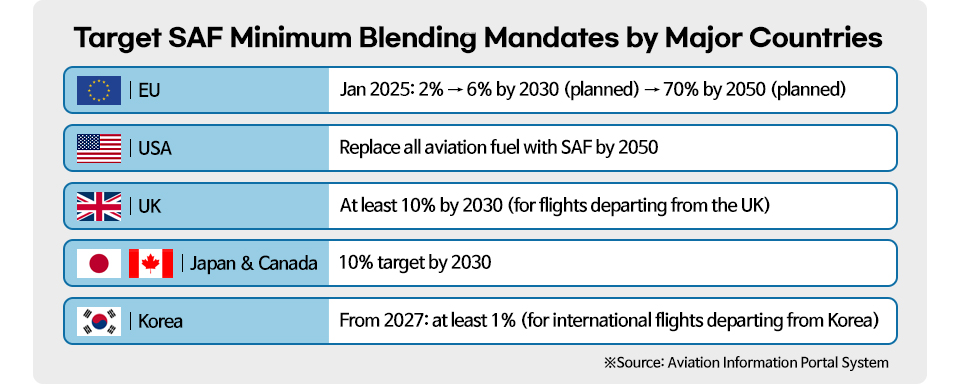

The global SAF market is growing rapidly as countries around the world gradually increase mandatory SAF blending requirements. By 2030, the United States, Japan, and Singapore plan to require SAF to account for 10% of total jet fuel use. The European Union (EU) has set a target of 6%, and Indonesia aims for 2.5%. Korea is also aligning with these global efforts. In August 2024, the government announced a policy that will make a 1% SAF blend mandatory for all international departing flights starting in 2027. As a result of these policy shifts, the global SAF market is expected to grow to around USD 67 billion (approximately KRW 92.4 trillion) by 2030 — roughly 30 times its current size.

If the SAF market is formed, various raw materials including biomass will be required, and there is a high possibility that the global raw material supply chain will be reorganized. Therefore, countries that possess raw materials or have strengths in raw material development are paying close attention to SAF as a new growth industry. In the past, the aviation fuel market was a monopoly and oligopoly market based on crude oil as a single raw material. However, because SAF uses various raw materials such as oils and fats, herbaceous and lignocellulosic biomass*, and industrial off-gases (CO, CO2, H2), the market has shifted to an intensely competitive one.

*Herbaceous and lignocellulosic biomass refers to trees and herbaceous plants containing cellulose, as well as products and waste derived from them. It is mainly used as a raw material for the production of biofuels, bioplastics, and biochemical substances.

U.S. Eyes SAF as a New Growth Industry

The United States is emerging as an optimal location for SAF production, leveraging its competitive advantage in producing bioethanol, a next-generation SAF raw material, from agricultural crops such as soybeans, corn, and sugarcane, as well as from agricultural byproducts. The Trump administration has also expressed interest in fostering the domestic SAF industry, pledging to maintain support under the Inflation Reduction Act (IRA).

In May 2025, the administration announced a restructuring plan to dramatically reduce or terminate clean energy tax credits. However, it maintained the Section 45Z Clean Transportation Fuel Credit for SAF, which provides up to USD 1.75 per gallon (approximately KRW 2,419) in incentives, and extended its expiration date by five years, from 2027 to 2032. In particular, while continuing to support fuels that achieve at least a 50% reduction in CO2 emissions, the U.S. framework, unlike global standardization efforts, excludes Indirect Land Use Change (ILUC)* CO2 emissions from its calculation boundary. This approach has enabled corn-based bioethanol to be included as an eligible fuel for federal support.

*Indirect Land Use Change (ILUC) refers to land-use changes that occur when farmland or pasture previously used for food or feed crops is converted to biofuel crop production, and to meet the displaced demand, forests or grasslands that had been used for other purposes are cleared and converted into cropland.

In other words, when corn in the United States is used for bioethanol, the supply of corn for food decreases, leading other countries to convert forests into cropland to meet that demand. Because corn has high ILUC emissions, it is a crop with a low CO2 reduction rate. However, in the United States, because ILUC emissions are excluded from the CO2 calculation boundary, corn’s CO2 reduction rate rises to more than 50% compared with conventional jet fuel, and it has therefore been included as an eligible fuel for support programs.

Japan Takes an Active Role in Building the SAF Market

How is Japan responding? At the U.S.–Japan summit in February 2025, Japan’s Prime Minister Shigeru Ishiba stated that securing a stable supply of resources such as bioethanol, in addition to LNG, from the United States would bring great national benefit to Japan. President Trump also noted his close relationship with the farming community and expressed strong interest in building a bilateral supply chain based on bioethanol.

Japan, leveraging the resource development capabilities of its general trading companies, is establishing a supply network for SAF raw materials such as used cooking oil, vegetable oils, and bioethanol. To encourage investment in domestic SAF production, the government provides subsidies covering between one-third and one-half of capital costs. To meet its mandate requiring 10% SAF use by 2030, Japan will need about 1.3 million tons of SAF per year. Four major refiners are currently reviewing six SAF production projects, and the government plans to cover between one-third and one-half of the investment depending on the technology. Japanese trading companies are participating as reliable raw material suppliers for SAF production in Japan through two of these projects, importing bioethanol from the United States and Brazil. As Japan’s domestic SAF production increases, they are expected to expand their role from supplying the domestic market to exporting SAF.

China and India are Transitioning from Raw Material Exporters to SAF Producers

China is shifting toward producing and exporting SAF domestically as the United States has strengthened import tariffs on Chinese used cooking oil, making it more difficult to export raw materials, and as demand for SAF has expanded mainly in the European Union (EU). One of China’s SAF producers, Zhejiang Jiaao Enprotech, has received government approval to export up to 370,000 tons of SAF and has already exported 13,400 tons this year.

India also has abundant SAF raw materials, including used cooking oil and crop residues, and it is expected that the country will be able to produce up to 24 million tons of SAF by 2030. As the domestic aviation market continues to grow rapidly, up to 10 million tons are expected to be consumed domestically, and the remainder will be directed toward exports.

POSCO Group Secures Diverse Core Raw Materials for SAF Production

Korean companies are also actively pursuing the SAF market. POSCO possesses a range of raw materials that can serve as a foundation for expanding into the SAF business, making it possible to enter the market through collaboration with refiners.

▲ POSCO International Indonesia palm plantation (left) and workers at the palm plantation. (Image Source: POSCO International)

POSCO International began developing plantations on Papua Island, Indonesia, in 2011 and started commercial palm oil production in 2016. In the palm oil refining process, various byproducts such as palm oil mill effluent and empty fruit bunches are generated, and since they are recognized as SAF raw materials, refiners’ interest is high. Sugarcane and corn, which are drawing attention as next-generation SAF raw materials, and bioethanol made by saccharifying them, can also be secured through POSCO International’s trading capabilities.

POSCO International has already laid the groundwork for growth in the eco-friendly business market, including SAF, by obtaining two international certifications in October 2024. The certifications obtained are ISCC EU*, a global certification that ensures the sustainability of biofuel production in accordance with the EU’s Renewable Energy Directive, and ISCC CORSIA**, a certification that guarantees the sustainability of aviation fuels. Through the acquisition of these international certifications, POSCO International has secured both the qualification to export biofuels and raw materials to the European market and the eligibility to supply raw materials for SAF production. This achievement is anticipated to provide substantial opportunities for growth in the EU and the international aviation industry.

*ISCC EU (International Sustainability and Carbon Certification EU) is an international certification program that verifies the sustainability of biofuels in accordance with the European Union (EU) Renewable Energy Directive.

**ISCC CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation) is a program that certifies Sustainable Aviation Fuel (SAF) that meets the standards of the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) established by the International Civil Aviation Organization (ICAO).

▲ POSCO Holdings, along with LG Chem, the Korea Research Institute of Chemical Technology, and Gyeongsangbuk-do, has formed the “Steel Industry CCU Consortium” and is participating in the mega project for carbon dioxide capture and utilization promoted by the Ministry of Science and ICT. The CCU Consortium proposed the Pohang Steelworks as the demonstration site and received final approval from the Ministry of Science and ICT in October 2024, aiming to start the demonstration project in 2026 after a preliminary feasibility study in 2025.

Various by-product gases are generated at POSCO’s steel mills. Among these, carbon monoxide (CO) and CO2 are regarded as next-generation SAF raw materials due to the absence of supply limitations. This technology involves producing SAF by converting CO into bioethanol and refining it into aviation fuel, or by reforming* CO2 into CO and synthesizing it with clean hydrogen. The Future Technology Research Laboratories of POSCO Holdings, in collaboration with LG Chem, plans to initiate a large-scale carbon capture and utilization (CCU) mega project in 2026, aimed at capturing CO2 and converting it into SAF raw materials. Upon successful completion of the demonstration project, POSCO is expected to enter the next-generation SAF market.

*Reforming is a technology that uses a metal catalyst to react CO2 and hydrocarbons such as methane to produce synthesis gas (a mixture of hydrogen and CO).

Preemptive Entry into the SAF Market to Seize Opportunities

So, is the transition of the aviation fuel market to SAF an opportunity or a threat for Korean companies? As Korea is the world’s leading exporter of aviation fuel, the global shift to SAF is seen more as a threat than an opportunity for Korean companies. For domestic aviation and refining industries, slowing down the speed of the transition to the SAF market may be advantageous in the short term.

ⓒ Getty Images Bank

However, since SAF is a strategic item that can change the structure of the multi-trillion-won aviation fuel market, it is important to note that major countries are recognizing it as a new industry and are actively participating in market creation. In particular, considering that the United States, Australia, Japan, Singapore, and the Netherlands, which are actively participating in SAF market creation, are Korea’s major aviation fuel export destinations, the market should be reviewed from a comprehensive perspective of defending the existing aviation fuel market and creating new SAF industries.

POSCO Group needs to review ways to participate in the SAF market in advance by utilizing POSCO International’s resource development capabilities and POSCO’s CCU technology using carbon dioxide. It is especially important to review various business models, including preemptively participating in overseas markets, which are expanding relatively quickly, beyond the domestic model, where the pace is expected to be slower.