l Standalone sales at about 7 trillion KRW; operating profit at 458.1 billion KRW

l Increase in domestic sales and stable performance from global infrastructure business help boost consolidated operating profit by 26.5% QoQ

l Current ratio at 497.1% — among the best in domestic companies

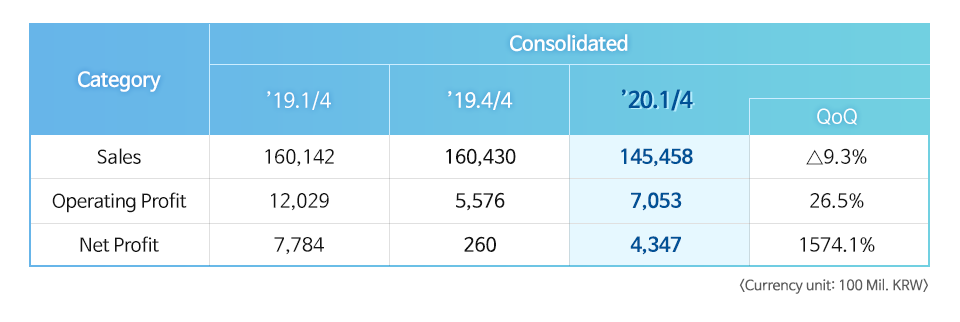

On April 24, POSCO reported its Q1 business performance on a consolidated basis in its regulatory filing. POSCO’s Q1 sales totaled 14.545 trillion KRW. The company’s Q1 operating profit was at 705.3 billion KRW with a net profit of 434.7 billion KRW.

Despite the global spread of COVID-19, POSCO achieved a boost in consolidated operating profit by 26.5 percent QoQ with an operating profit rate of 4.8 percent. The company maintained its profitability in the steel market by increasing the share of domestic sales. Stable profits from POSCO International’s Myanmar gas fields and improved performance from POSCO E&C also attributed to the company’s performance, while POSCO Energy continues to benefit from lower fuel costs.

POSCO’s standalone Q1 sales reached 6.969 trillion KRW with an operating profit of 458.1 billion KRW. The net profit was at 453 billion KRW.

As overhaul operations were carried on at Gwangyang Work’s No.3 blast furnace and its production lines, QoQ production of crude steel and steel products showed a drop, by 540 thousand tons and 240 thousand tons respectively. However, a decrease in raw material costs in the final quarter of 2019 helped achieve an increase in operating profit by 24.8 percent. As a result, the company’s operating profit rate stood at 6.6 percent — increased by 1.6 percent QoQ.

Ahead of the COVID-19 crisis, POSCO secured 3.3 trillion KRW in January to finance its debt, which helped enhance the company’s liquidity. According to the current ratio* — an indicator of corporate stability, — POSCO ranked one of the highest among domestic companies with a record of 497.1 percent on a separate basis. This number is a significant improvement from the current ratio of 2019 Q1 standing at 422.7 percent. Funds included in current assets totaled 11.7 trillion KRW on a separate basis, up 4 trillion KRW from 2019 Q1.

*Current Ratio: A ratio of Current Assets (assets that can be cashed out within one year) divided by Current Liabilities (debts that must be repaid within one year)

POSCO announced a 1 trillion KRW worth share buyback program on April 10, as an action to elevate shareholder value in the stock market affected by the COVID-19 crisis. As surplus funds were used for the measure, there are no changes to its dividend policy. POSCO’s dividend payout ratio is about 30 percent. POSCO has no plans for additional loans as well.

As the spread of COVID-19 continues globally, POSCO is preparing itself for harsher situations. With apparent impacts in major steel-using industries, such as automotive and construction, the demand for steel is expected to decrease and cause product prices to drop. In the given circumstances, the company plans to handle production and sales flexibly, carry out cost-saving efforts, and readjust investment priorities.