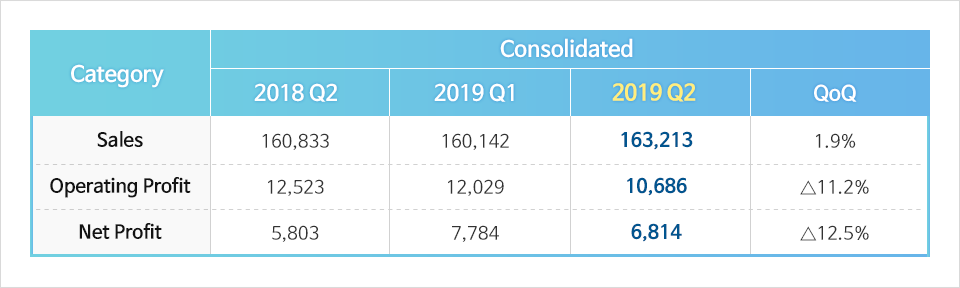

l Consolidated sales at 16.3213 trillion KRW; operating profit – 1.0686 trillion

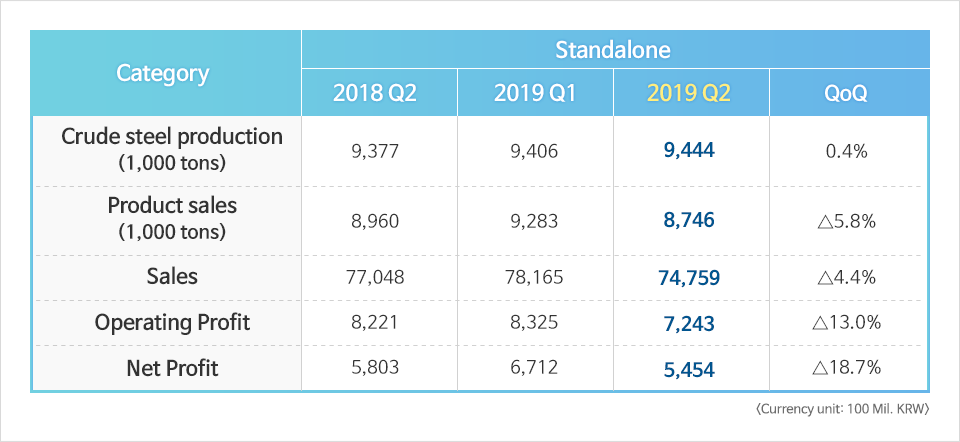

l Standalone sales at 7.4759 trillion KRW; operating profit – 724.3 billion

l Improved performance in global infrastructure with consolidated debt-equity-ratio at 65% – the lowest since 2010

POSCO’s operating profit surpassed one trillion KRW (848 million USD) on a consolidated basis – for eight quarters in a row.

On July 23 KST, POSCO reported its operating profit on a consolidated basis in its regulatory filing. The company’s Q2 sales totaled 16.3213 trillion KRW with 1.0686 in operating profit. The net profit was at 681.4 billion.

As for POSCO’s steel business, the QoQ operating profit saw an overall decline, yet the improved performance by POSCO INTERNATIONAL in global infrastructure – the rise of gas sales from Myanmar gas fields and profit increase in trading – led to 6.5% in operating margins surpassing one trillion KRW operating profits for eight consecutive quarters.

POSCO’s standalone financial statements showed an operating profit of 724.3 billion KRW and a net profit of 545.4 billion. Q2 sales reached 7.4759 trillion.

In currency exchange rates, the Korean won lost against the U.S. dollar, which brought up the sales price. However, partial repair work in production lines necessitated a temporary halt in steelworks, which brought down the production volumes. Furthermore, a decline in sales volumes and the hike in raw material prices led to the overall decline of the operating profit QoQ – 13% down from the previous quarter. Meanwhile, the sales of POSCO’s high-value product, World Top Premium (WTP), matched those of the previous quarter – which prevented a further decrease in operating profits. POSCO’s Q2 operating profit rate stood at 9.7%, 1.0% point down from the previous quarter.

POSCO’s financial soundness has strengthened. The consolidated debt-to-equity ratio dropped to a record low of 65% – the lowest since 2010. The low debt ratio is attributed to reduced debts, payment of accrued corporate tax, etc. The consolidated debt was at 19.2 trillion KRW – 2.6 times of the pre-depreciation Debt to EBITDA. Due to the repayment of bonds, and payment of unclaimed dividends, the standalone debt-to-equity ratio was at 17.8% – 2.2% point down from the previous quarter.

Meanwhile, POSCO revised up its annual sales volume target from 35.7 million tons to 36.2 million tons – consolidated and standalone sales targets were slightly revised up to 66.8 trillion KRW and 31.1 trillion KRW, respectively.

[POSCO Q2 Performance]