l Standalone sales at 30,374 billion KRW; operating profit – 2,586 billion KRW

l WTP (World Top Premium) sales volume record a 10 million-ton mark; POSCO affiliates — POSCO INTERNATIONAL and POSCO ENERGY — show solid performance

l A drop in the consolidated debt-to-equity ratio to 65.4% — the lowest since 2010

l The Board announces dividend payment of 10,000 KRW per share and pay-out ratio of 30%

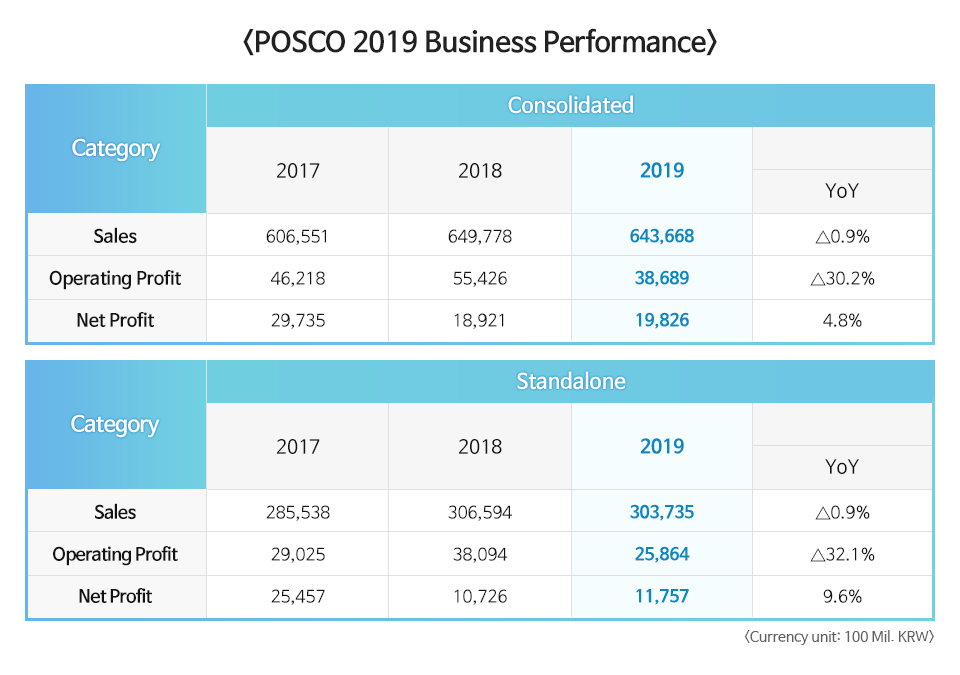

Last January 31, POSCO reported its 2019 business performance in its regulatory filing. The company’s 2019 consolidated sales recorded 64,367 billion KRW with 3,869 billion KRW in operating profit. The net profit was 1,983 billion.

The YoY consolidated sales and operating profit saw an overall decline and recorded 6.0% in operating margins.

Amidst the harsh conditions — the staggering global economy and decline in demand, protective trade policies of business partners, and the hike in raw material prices — POSCO was able to achieve a sales volume of 35,990 thousand tons, up 40 thousand tons from the previous year. Declines in consolidated operating profit were minimized thanks to the sales of POSCO’s high-value product, World Top Premium (WTP), recording a 10 million-ton mark.

The company’s performance can also be attributed to the improved earning of its affiliates. POSCO INTERNATIONAL reached the highest operating profit with solid sales records from Myanmar gas fields. POSCO ENERGY reclaimed its operating profit by direct LNG import and restructuring fuel cell business.

POSCO’s standalone financial statements showed sales of 30,374 billion KRW, and an operating profit of 2,856 billion KRW — a drop by 0.9% and 32.1%, respectively.

Despite unfavorable market conditions, POSCO’s financial soundness has continued to strengthen. The consolidated debt-to-equity ratio dropped to a record low of 65.4% — a 1.9% decrease from the previous year, and the lowest since 2010. POSCO’s net debt* reduced to 7,978 billion KRW, which is a drop by 1,553 billion KRW since last year. POSCO recorded 12,436 billion KRW as available funds — a 1,786 billion KRW up from last year — strengthening its ability to cope with the economic status of today.

*Net debt: Total debt minus total cash or liquid assets(available funds)

POSCO announced that its high competitiveness compared to global competitors, based on several factors — the development and sales of high-value steel products, cost competitiveness through an efficient production system, production competitiveness through continuous investment in facilities, and the ability to correspond to changes in the market.

Although POSCO’s YoY performance showed a decline, the Board announced a dividend payment of 10,000 KRW per share in 2019 saying that this is a measure to strengthen shareholder return policy following the solid consolidated net profit.

POSCO also proposed a dividend pay-out ratio of 30% over the next three years. POSCO has maintained a dividend of 8,000 to 10,000 KRW per share since 2004 and has been implementing a quarterly dividend policy, from the second quarter of 2016 in order to enhance long-term investor shareholder value.

POSCO expects steel prices to pick up in 2020, following the buoyancy in the global steel prices of China, the US, and other countries. Also, the signing of the “phase one” trade deal between the US and China last January 15, is set to resolve issues regarding stability.

POSCO plans to continue with the selection and sales of WTP products, to secure stable operating profit and lead the future market. The company is also to retain profitability through appropriate price policies — according to region and industry. In addition, to cope with demand industries due to the transition to new mobility of the future, an integrated marketing system will be set up for eco-friendly automotive. Green and premium steel products for construction are to be sold in a manner that differentiates them from the existing market.

As for the production sector, POSCO is to expand AI-based Smart Factory to improve productivity, quality, and cost competitiveness. The company further plans to innovate the quality assurance (QA) system of domestic and overseas subsidiaries, and build a global production system, ‘One POSCO, One Quality.’

For the new business sector, POSCO is to strengthen the production and marketing capacity of cathode and anode — materials needed for secondary batteries. POSCO will work on enhancing R&D for next-generation products. POSCO plans to invest and enable demonstration plants to start commercial production of lithium utilizing the lithium from Australia and Argentina. The lithium is the main material for batteries of electric cars.

The consolidated sales target for 2020 is 63,800 billion KRW, and the crude steel production and product sales targets are 36,700 thousand tons and 35,000 thousand tons, respectively. To strengthen the competitiveness of the steel division and foster new growth sectors, POSCO plans to invest 6,000 billion KRW. The investment will priorly be carried on regarding the environment, safety, and facilities within the EBITDA to improve competitiveness in the steel sector. All non-production-related investments will be selected only through a strict verification process. In 2019, the consolidated investment amounted to 3,000 billion KRW, which is 50% of the original plan.