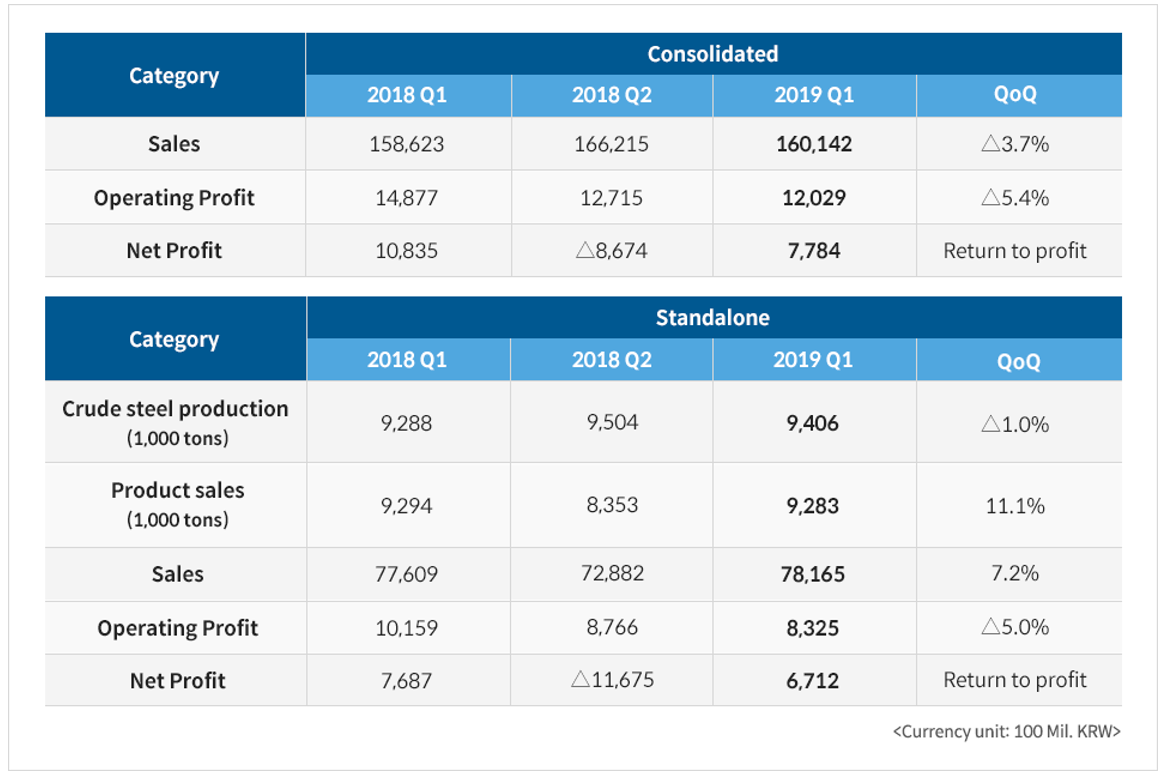

l Consolidated sales at 16.142 trillion KRW, with operating profit down by 5.4% QoQ

l Stable profits from global infrastructure, trade, and energy sectors help achieve over one trillion KRW operating profit for seven consecutive quarters

l Standalone sales reached 7.82 trillion KRW, with 832.5 billion KRW operating profit – down by 5% QoQ

On Wednesday, POSCO reported its operating profit on a consolidated basis in its regulatory filing. The company’s Q1 operating profit was at 1.2 trillion KRW ($1.04 billion) with a net profit of 778.4 billion KRW. POSCO’s Q1 sales totaled 16. 1 trillion KRW.

Despite the slight decline in QoQ operating profit owing to the sluggish steel market, POSCO achieved over 1-trillion operating profit for seven consecutive quarters with an operating profit rate of 7.5%. Such performance can be attributed to stable profits from POSCO International’s development of Myanmar gas fields while POSCO energy continues to benefit from the increased sales price of liquefied natural gas.

POSCO’s standalone financial statements showed an operating profit of 832.5 billion KRW with a net profit of 671.2 billion KRW. The Q1 sales reached 7.816 trillion KRW.

QoQ sales volume hiked by 11.1%, leading to overall sales increase by 7.2%, but operating profit saw a 5% decrease due to reduced sales prices. The operating profit rate QoQ stood at 10.7%, 1.3% point down from the previous quarter. However, the increased sales volume of POSCO’s World Top Premium (WTP) products, 13.5% increase on quarter, and lower raw material costs helped minimize further dip in operating profit.

POSCO’s financial soundness have strengthened. The consolidated debt-to-equity ratio increased 1.6% point QoQ to 68.9% due to the amendment of the lease accounting standards*. However, the company has maintained a steady cash flow with reduced debts. Based on the standalone statements, the debt-to-equity ratio rose 0.4% point to 20% due to an increase in the unclaimed dividends. Net cash also saw an increase of 440 billion KRW QoQ to 3.45 trillion KRW.

* Amendment to the lease accounting standards: under IFRS 16, lease commitments are recognized as assets and liabilities in a manner similar to finance leases.

POSCO expects steel prices to pick up slightly due to the buoyancy in China’s economy and solid growth in emerging economies. But it also predicts a certain amount of ripple effects from subdued global demand for steel and rising commodity prices. As such, the company will continue making efforts to generate revenue through various cost-cutting measures and expanded value-added offerings such as WTP products.

Meanwhile POSCO’s consolidated sales totalled 66.3 trillion KRW (standalone sales at 30.1 trillion KRW), meeting the sales projection set at the beginning of this year.