l Consolidated sales of 64.9778 trillion KRW and operating profits of 5.5426 trillion KRW (4.47 billion USD) in 2018

l POSCO achieves the operating profit of over 1 trillion KRW for the six consecutive quarters

l POSCO’s domestic and overseas subsidiaries achieve record sales: PT.Krakatau POSCO, POSCO Maharashtra Steel, POSCO Chemtech

l The Board to increase dividends per share for the first time in seven years

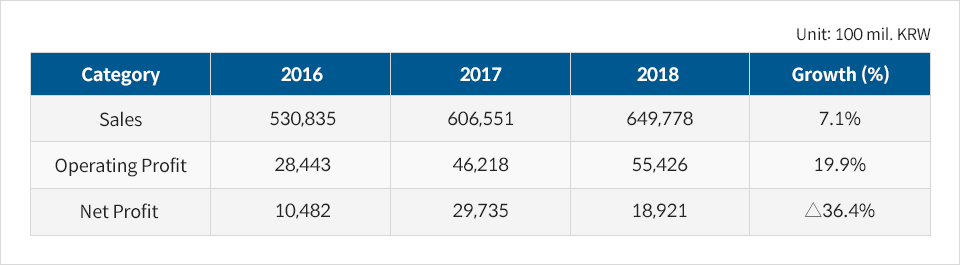

POSCO reclaimed the operating profits of 5 trillion KRW (approx. 4.47 billion USD based on Jan 30 exchange rates) for the first time in seven years, based on its consolidated financial statements.

According to the company briefing held on January 30th, POSCO achieved the consolidated sales of 64.9778 trillion KRW, operating profit of 5.5426 trillion KRW, and the net profit of 1.8921 trillion KRW, respectively.

POSCO achieved the sales of 60 trillion KRW level consecutively for two years since 2017, recovering the operating profit of 5 trillion KRW for the first time since 2011. Compared to the previous year the consolidated sales grew by 7.1%, operating profit by 19.9%, and operating profit margin by 8.5%.

Despite the challenging economic climate across the globe, including economic slowdown, a decline in demand, and pervasive trade protectionism, POSCO was able to achieve the operating profit of over 1 trillion KRW for the six consecutive quarters. The company’s performance can be mainly attributed to the strong sales record of high value-added steel and the improved earnings of its affiliated companies.

POSCO’s various subsidiaries and affiliates – both domestic and abroad – saw overall improvements in their performance. Two of POSCO’s production corporations, PT.Krakatau POSCO in Indonesia which is an integrated steel mill, as well as POSCO Maharashtra Steel in India, for automotive steel and cold-rolled steel, achieved the highest operating profits.

POSCO Daewoo and POSCO E&C both took favorable turns in trade and construction divisions respectively, and POSCO Chemtech achieved the highest sales since its establishment owing to the increased sales, trailed by the market growth in anode materials.

Consolidated net income, however, declined by 36.4% compared to the previous year. The decline was due to the impairment of assets and equity securities of the affiliated companies; one-off valuation losses on securities despite no actual cash outflow; the reduced gain on disposition of marketable securities; as well as an increase in corporate tax expenses.

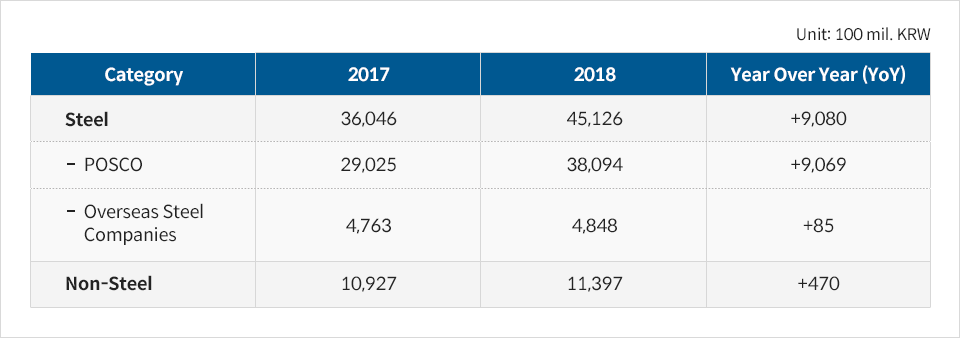

<Combined Operating Profits>

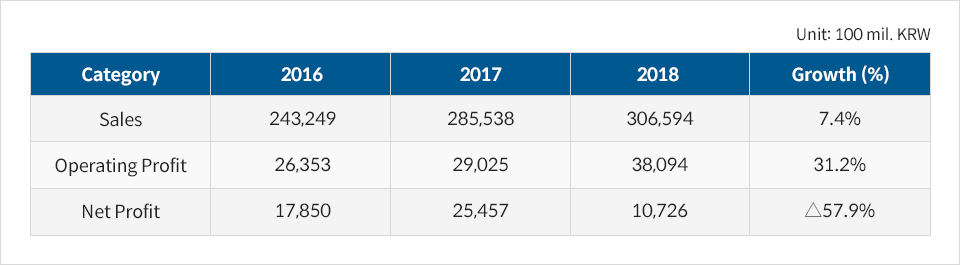

As opposed to consolidated sales, individual sales and operating profits each increased by 7.4% and 31.2% compared to the previous year – to 30.6594 trillion KRW and 3.8094 trillion KRW respectively. Net profit was at 1.0726 trillion KRW.

Following the expansion of Pohang No. 3 blast furnace as well as the record sales of World Premium Products which accounted for 55.1% of sales, both production and sales saw a remarkable boost, contributing to the overall growth of operating profits.

POSCO’s financial soundness is also continually improving. Due to the repayment of 854.4 billion KRW loan last year, the total amount of debts decreased. However, due to the repayment of hybrid securities of 1.16 trillion KRW, the company’s equity also decreased, resulting into the consolidated debt-to-equity ratio increasing slightly by 0.8 percentage to 67.3% – still at its lowest since 2010. Debt to EBITDA ratio fell to 2.5 from 2.9 from the previous year, thereby meeting the requirements for the improved credit rating set by global credit rating agencies.

* Hybrid securities are securities the deadlines of which can be extended as per the executives’ decision and are counted towards the capital in accounting

On the same day, POSCO also announced the company’s mid-term management strategy. In the Steel sector, the company will strengthen measures to increase its profits against protectionist trade practices by expanding sales of World Top Premium Products. In the Non-steel sector, POSCO will reinforce its competitiveness by reforming business practices and profit model in trade, construction, and energy divisions.

In the New Growth sector, POSCO Chemtech and POSCO ESM will finalize the merge process to maximize integrated synergies with a view to boosting the competitiveness of the secondary battery materials. The company’s objective is to achieve 2 trillion KRW sales level by 2021. The company will all together diversify combined margins of Steel, Non-Steel, and New Growth sector to 44%, 53% and 3% by 2021, respectively – from the previous 49%, 50%, and 1% profit margins. Accordingly, the company presented the consolidated sales of 78 trillion KRW and a consolidated debt-to-equity ratio of 65% for 2021.

POSCO has been paying 8,000 KRW of dividends per share for the past six years. To strengthen shareholder return policy, however, the board of directors decided to increase the amount to 10,000 KRW – a 2,000 KRW increase for the first time since 2011. This year, the company plans to match the stable cash dividends level of 2018. Prior to this, POSCO has been implementing a quarterly dividend policy, from the second quarter of 2016 in order to enhance long-term investor shareholder value.

<POSCO’s 2018 Business Performance – Consolidated>

<POSCO’s 2018 Business Performance – Individual>