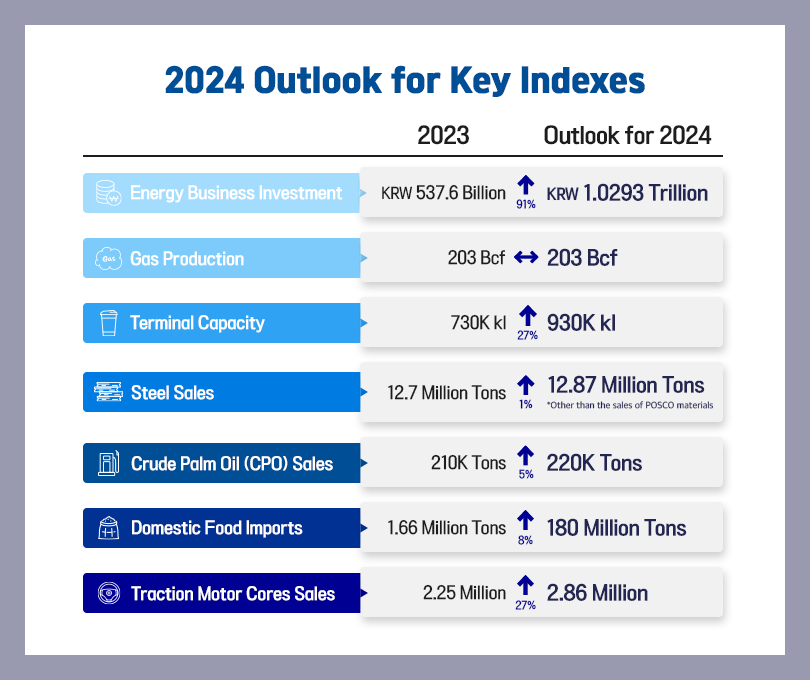

Invested a total of KRW 1 trillion in energy industry this year, already selling more traction motor cores than the last year

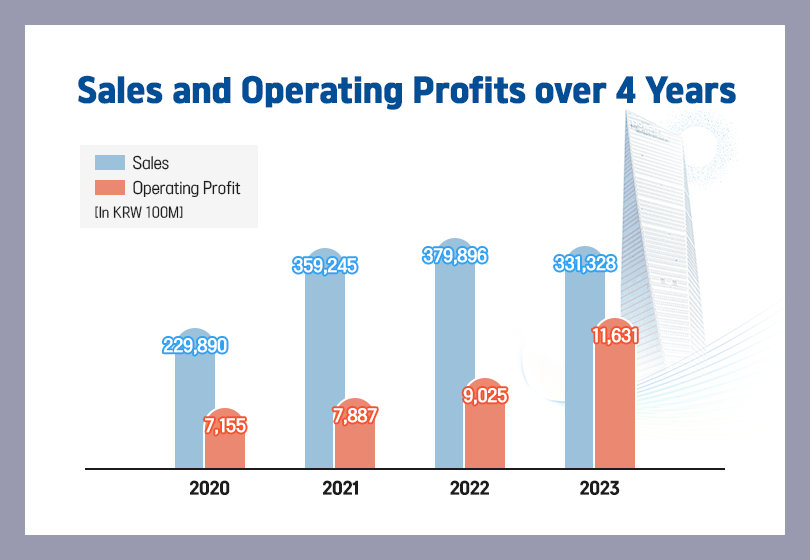

Last year’s sales were KRW 33.1328 trillion and the profit KRW 1.1631 trillion, demonstrating a synergy from the merger

Announced the mid-term shareholder-friendly policies while allocating dividend amounts to approximately 25% of payout ratio and considering midway dividend

Entering its second year since the merger, POSCO INTERNATIONAL takes on its investment for becoming a global integrated corporation.

POSCO INTERNATIONAL (Vice-chairman Jeong Tak) set ‘global expansion’ as its core keyword for 2024 and revealed its plan to advance its major businesses by strengthening its value chain.

First of all, there will be a total of KRW 1 trillion worth of investment into the energy business. In the upstream sector, the company is aiming to establish a production system that triples the production of Senex Energy, Australia (20→60PJ/year) by 2025. The company already signed sales contracts with eight local clients* for the increased gas production of 150PJ.

* AGL, Orora, E-Australia, Visy, BlueScope, Engie, Liberty Steel, and CSR

In the midstream sector, which involves energy transportation, the company plans to finish building its Gwangyang Tank No. 6 with a capacity of 200K ㎘ this year and extend its capacity further with the construction of Tanks No. 7 and 8 for an additional capacity of 400K ㎘ by 2026.

POSCO INTERNATIONAL is expediting its efforts in the renewable energy business as well. With its experience in onshore wind farm at Sinan, POSCO INTERNATIONAL aims to make this the first year of being in the group’s vanguard for advancing a business that is centered around offshore wind farm. Its goal is to establish a zone of offshore wind farm business that stretches over the west, southwest, and southeast seas and generates 2.0GW by 2030.

For the steel business, the company strengthened its position as the group’s direct trading sector, focusing on expanding the global market for the group’s products. For the green material business, the company has mapped out its plans to drive the group’s integrated marketing under the lead of Green Management Department―which was newly established last year―and become the prime mover of raw materials for secondary batteries.

For the traction motor core business, the company is constantly expanding its overseas production bases to achieve a ‘worldwide production system for 7 million units or more by 2030.’ It established Plant 1 in Mexico last year to respond to ever-increasing customer demands, and is currently reviewing the plan to start establishing Plant 2 in Mexico and another plant in Poland by the first half of this year. It has already landed orders for 2.86 million traction motor cores this year, far exceeding the total sales of last year that was 2.25 million.

For the agro business, the company has set a goal to import 1.8 million tons of food into Korea this year. This represents an 8% increase from last year. In addition, it is promoting the foundation of agricultural joint ventures in Australia and the U.S. to enhance the stability of raw grain procurement, and plans to begin construction of palm oil refineries in the first half of this year through the joint venture it has established with GS Caltex in Indonesia.

Meanwhile, for the first time since its foundation, POSCO INTERNATIONAL officially announced its ‘era of KRW 1 trillion operating profit’ at the performance presentation on the 31st of last month.

According to the official announcement, the company achieved annual sales of KRW 33.1328 trillion, an operating profit of KRW 1.1631, and a net profit of KRW 680.4 billion in 2023. This performance, compared to that of last year, represents a 12.8% decrease in sales, but a 28.9% increase in operating profit.

The expansion of energy value chain through the merger and the increase in sales and return of eco-friendly industrial materials for the European market can account for the drastic upturn in profitability.

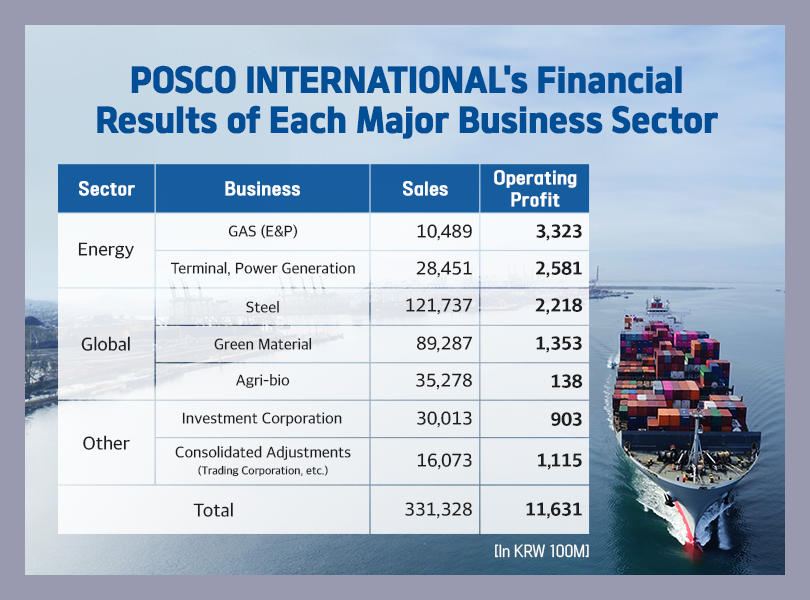

Looking at the performances of each business sector, energy sector reported KRW 3.894 trillion in sales and KRW 590.4 million in operating profit, resulting in a solid profit year on year, thanks to the completion of the LNG value chain.

The global business sector reported sales of KRW 24.6302 trillion and an operating profit of KRW 370.9 billion, demonstrating solid growth despite the escalating risks of trade barriers. On top of all this, other business sectors (investment/trading corporation, etc.) benefited from the global steel business and favorable regional market conditions, making a contribution of KRW 4.6086 trillion in sales and KRW 201.8 billion.

At the roadshow on the 31st, POSCO INTERNATIONAL announced its ‘Mid-term (FY 2023-2025) Shareholder-Friendly Policy’ to materialize its corporate pursuit of maximizing value for shareholders.

According to the announced policy, it is going to allocate the dividend around 25% of controlling stockholders’ consolidated net income and consider an implementation of interim dividend. It also changed the record date of the year-end dividend to after the shareholders’ meeting to increase the predictability and security of dividend income.

It plans to continuously develop a variety of policies for shareholder returns and enhance the communication with its shareholders to establish itself as an exemplary company that shareholders can trust.