POSCO and food business — many people will have a hard time connecting the dots between the two. In Korea, steel is known as the rice of the whole industry, reflecting the reality where rice is the main diet of the country.

Does this mean the ‘food’ here refers to steel? Because that would make much more sense, but no! It doesn’t.

POSCO Group has been involved in the agro-resources for a while now. As of late, the company is really growing the business, designating it to be included as one of POSCO’s top 100 reforms.

In September this year, POSCO INTERNATIONAL established a grain export terminal in Ukraine as part of the reform effort. Agro-resource is much more than just profits, as food security is becoming more important. Why is POSCO Group in it, and what does the company aspire to achieve through the business? POSCO Newsroom reports.

l Agro-resources — Why Is It Important?

In the 2000s, severe drought swept across Europe and Latin America, the world’s top wheat-producing regions. Global crop production plunged incurring sharp food inequality across nations. Real concerns on food shortages started surfacing — now, food security has become one of the top policy agendas worldwide.

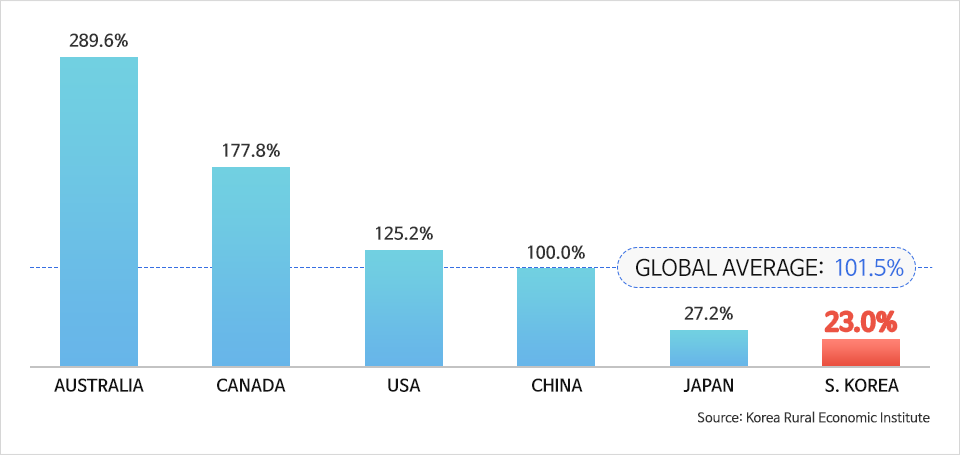

What is the reality of Korea’s food security? The 2018 Global Food Safety Index ranks Korea 25th out of 113 countries with a score of 75.6. Not only did Korea score low compared to other OECD countries, but the country’s grain self-sufficiency is declining every year. Considering Korea’s traditional grain-based diet and ever-increasing meat consumption which require huge amount of grain feed, Korea’s GFSI figure is alarming.

Based on the statistics from the last three years, the Korea Rural Economic Institute reports that Korea’s grain-self sufficiency ratio is at 23% — the global average is 101.5%. Korea’s annual grain demand is over 20 million tons including both for human and animal consumption, but except for rice, Korea relies mostly on imports. This level of high dependence will exacerbate the food crisis whenever the global grain prices fluctuate, which is why securing sustainable future food resources is crucial.

l From the Industrial Rice to the Actual Rice

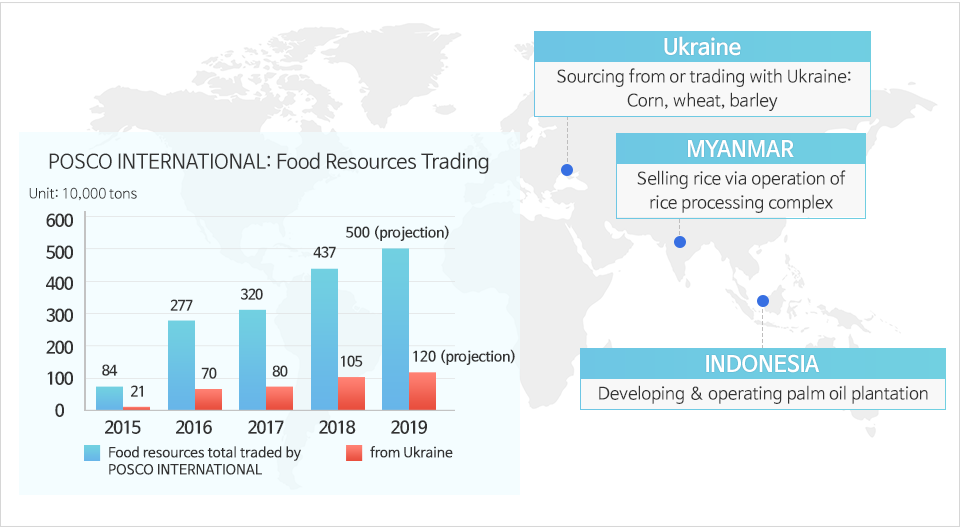

As for the trade volumes, POSCO INTERNATIONAL is Korea’s number one agriculture trader. In addition to the direct involvement in food production, the company is generating long-term and stable profits through its global grain value chain ranging from processing, storage, transportation to terminal operations. Some of its biggest operations include the palm oil business in Indonesia, rice processing complex in Myanmar and grain terminal in Ukraine.

(1) Farm Value Chain: Palm Oil Business, Indonesia

▲ Palm oil plantation in Indonesia — POSCO INTERNATIONAL

POSCO INTERNATIONAL’s palm oil business in Indonesia is a type of farm value chain which includes direct production activities. In 2011, POSCO INTERNATIONAL established a plantation in Papua, Indonesia. As of 2017, palm oil occupies 39% of the edible oil market, and Indonesia is one of the world’s top palm oil producers. Together with Malaysia, Indonesia produces 85 percent of the world’s palm oil. Amidst the world’s bio market spotlighting palm oil for its wide usage, Indonesia’s palm oil is consumed domestically and is also exported to other countries in Asia, Europe.

(2) Processing Value Chain: Rice Processing Complex, Myanmar

▲ Rice Processing Complex in Myanmar (RPC) — POSCO INTERNATIONAL

After Indonesia, POSCO INTERNATIONAL subsequently sought after a new project in Myanmar, one of the major rice-exporting countries. With 20 years of rice-importing experience under its belt, POSCO INTERNATIONAL established a processing value chain in Myanmar: the company first purchases paddy from producing area in Myanmar; subsequent procedures like drying, storage, milling, and inspection can be done altogether, not at separate places. The first plant has been in operation since 2017, and the second plant was completed earlier this year. The plants are set to process and distribute 100,000 tons of rice annually.

(3) Distribution Value Chain: Grain Terminal, Ukraine

▲ POSCO International Ukraine Mikolai Grain Terminal

Ukraine is among the world’s top five countries exporting major grains such as corn, wheat, and soybeans. POSCO INTERNATIONAL established a grain procurement corporation in the world’s major grain belt, Ukraine, subsequently establishing a grain export terminal before any other Korean companies. With the annual capacity of the terminal expected at 2.5 million tons, the operation of the terminal took off this year. By securing the grain terminal, POSCO INTERNATIONAL has now established a distribution value chain, followed by the previous farm and processing value chains.

With this establishment, POSCO INTERNATIONAL can have logistics control which deals with purchase, inspection, storage, shipment of Ukrainian grain coming into the terminal. Efficient inventory management is an additional benefit. The fact that a private company like POSCO INTERNATIONAL is operating an overseas export terminal not only means its capacity growth as a global grain trader, but also signifies its potential contribution to establishing Korea’s grain procurement system for the future.

l The Completed Value Chain to Incur 5 Trillion Won in Sales and Improve Food Security

POSCO INTERNATIONAL aspires to grow its agro-resources business into 5-trillion won cash cow business by 2030. To that end, the company is stepping up its midstream expansion and the completion of the value chain. The palm oil business in Indonesia is starting to make profits, and now there is a much more positive outlook on the second plant of Myanmar’s rice processing complex. By establishing the company’s comprehensive value chain system encompassing food distribution, production, procurement, and processing, the company will further strengthen its base for the agro-resources as a future core business.

Meanwhile, as more consumers opt for non-GMO food products, and logistics efficiency improves, Ukraine’s crop export to Asia is increasing. Therefore, the Ukrainian government is proactively seeking to improve aging storage facilities and to develop grain export terminals. POSCO INTERNATIONAL’s grain terminal business is significant in that private company is cooperating with the government for overseas grain stockpiling.

As for Korea’s food security, it is also strategically important to diversify base grounds such as Ukraine to cope with more flexibility in responding to the food fluctuations that can occur arising from climate change and diplomatic conflicts. This is why overseas grain storage business by a private company like POSCO INTERNATIONAL becomes even more significant. It is also important to establish a supply chain in the Black Sea port, which exports approximately 90% of Ukraine’s total grain exports. Solid construction for one of POSCO Group’s new growth engines has begun — and the company is more prepared than ever to take the next step.