With the International Maritime Organization (IMO) set to implement a GHG pricing mechanism in 2028, new possibilities and opportunities in LNG core materials and gas business are coming up. We take a look at how the decision to impose this shipping carbon tax could impact POSCO Group’s business, alongside insights from Ki-Yoon Jang, Senior Researcher at POSCO Research Institute.

Senior Researcher Kee-Yoon Jang, POSCO Research Institute

I Upcoming GHG Pricing Mechanism to Drive Changes in Global Shipping

The IMO has finally gone ahead with the official introduction of a shipping carbon tax (GHG pricing mechanism). Starting in 2028, all vessels over 5,000 tons will be subject to the tax. This marks the outcome of long-standing discussions aimed at cutting down on greenhouse gas emissions from maritime transport.

▲ The 83rd Marine Environment Protection Committee (MEPC 83), held by the International Maritime Organization (IMO) from April 7 to 11. (Image source: Korea Maritime Safety Authority(KOMSA))

This decision was finalized at the 83rd session of the Marine Environment Protection Committee (MEPC 83), held recently. The IMO has set out a goal for the global shipping industry to cut back carbon emissions by up to 43% compared to 2008 levels by 2035. If this target is not met, shipping companies will have to pay out a carbon tax ranging from USD 100 to as much as USD 380 per ton of CO₂ emitted. The exact amount may vary depending on vessel size, voyage distance, and emission volume, but the industry does not take this lightly.

*IMO: A specialized agency of the United Nations responsible for protecting the marine environment and ensuring safe and efficient shipping.

The global revenue expected from the GHG pricing mechanism is projected to reach USD 10 billion annually, or approximately KRW 14.25 trillion. This poses a considerable burden on the shipping industry. However, the IMO’s decision is anticipated to go beyond simple taxation, serving as a catalyst for reducing carbon emissions across the maritime sector. Some shipping companies have already begun introducing LNG-powered vessels, which emit less greenhouse gases compared to conventional ships, and are expanding the use of low-carbon fuels in a proactive effort to respond to the new regulations.

I Background of the GHG Pricing Mechanism

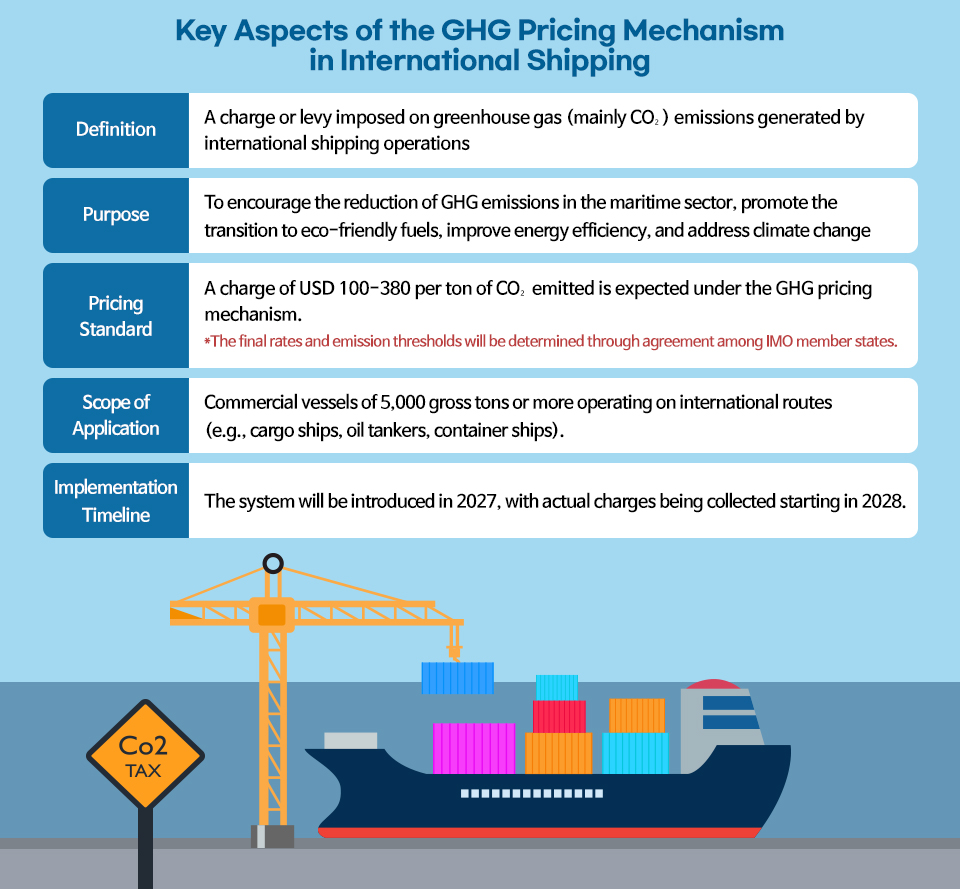

According to data published by the International Energy Agency (IEA) in 2022, the transportation sector accounts for 16% of global greenhouse gas emissions. Of this, maritime shipping is responsible for approximately 2%. In other words, the shipping industry accounts for approximately 2% of total global greenhouse gas emissions. This figure is by no means insignificant, especially when compared to road transport (12%) and aviation (1%). Accordingly, the role of the maritime sector in achieving global decarbonization goals has become increasingly critical.

The issue of GHG emissions from international shipping began to receive serious attention in the early 2000s. In 2003, the International Maritime Organization (IMO) initiated its first studies on GHG emissions in the maritime sector. Although the Kyoto Protocol*, which entered into force in 2005, assigned legally binding reduction targets to developed countries, the shipping sector was not directly included. Instead, responsibility for regulating maritime emissions was delegated to the IMO, leading to growing expectations for its role. Since then, the IMO has introduced energy efficiency standards for ships, implemented mandatory fuel consumption reporting systems, and actively advanced discussions on market-based measures such as carbon pricing and emissions trading schemes to address maritime carbon emissions.

In 2023, talks on introducing a GHG pricing mechanism in international shipping really picked up speed. The IMO drew up a new greenhouse gas (GHG) strategy and officially adopted the goal of achieving carbon neutrality in international shipping by 2050, thereby setting in motion the full-scale introduction of a GHG pricing mechanism. As a result, at the 83rd session of the Marine Environment Protection Committee (MEPC 83) held in April this year, it was decided that the GHG pricing mechanism would take effect in 2028. Once IMO member states agree on specific rates and application standards through further discussions, the mechanism is expected to be implemented as planned.

*Kyoto Protocol: An international agreement adopted at the 3rd Conference of the Parties (COP3) to the United Nations Framework Convention on Climate Change (UNFCCC), held in Kyoto, Japan, in 1997. It was the first legally binding treaty to set greenhouse gas (GHG) emission reduction targets for developed countries, covering gases such as carbon dioxide (CO₂), methane (CH₄), and nitrous oxide (N₂O). The protocol entered into force in 2005. While developed countries were subject to reduction obligations, developing countries were exempt.

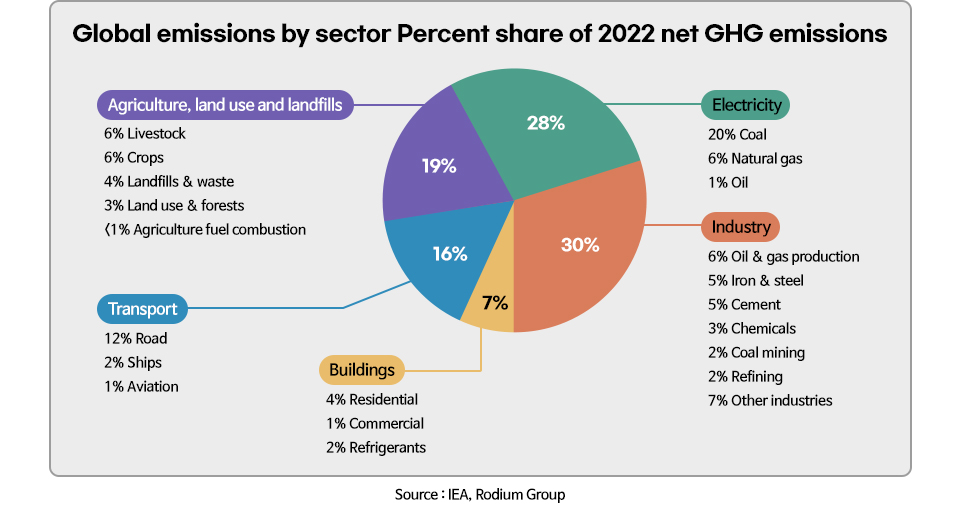

I Anticipated Increase in Demand for LNG-Related Core Materials Following Implementation of the GHG Pricing Mechanism

How is the implementation of the GHG pricing mechanism expected to affect the shipping industry? In particular, vessels operating on conventional marine fuels such as marine gas oil (MGO) and heavy fuel oil (HFO) are likely to experience a significant rise in operating costs. By contrast, LNG (liquefied natural gas)-powered vessels emit 20-30 percent less CO₂, making them subject to a considerably lower tax burden. As a result, demand for LNG fuel is expected to increase*, prompting shipping companies to increasingly consider LNG-fueled vessels when placing new ship orders. This shift is expected to be especially evident in long-haul routes and large vessel segments, such as container ships and oil tankers.

*Although the expansion of LNG usage may lead to increased methane (CH₄) emissions in the long term, and competition with zero-carbon fuels such as ammonia and hydrogen is inevitable, LNG is expected to maintain its position as a transitional fuel in the maritime sector through 2040.

▲ The photo above shows Gwangyang Terminal 1, completed by POSCO International in July. POSCO International is currently developing dedicated LNG bunkering infrastructure at the Gwangyang LNG terminal as part of its related business initiatives. A 12,500㎥ LNG bunkering vessel is under construction and is scheduled to begin full-scale operation in the second quarter of 2027, upon delivery. (Image Source: POSCO International)

As the number of LNG-powered vessels increases, the demand for LNG bunkering is also expected to rise. Rather than building LNG storage and refueling facilities at every port, constructing bunkering vessels that can supply LNG at sea is considered more cost-effective. Accordingly, the increase in LNG-fueled ships is likely to lead to a corresponding expansion in LNG bunkering infrastructure at ports. Major ports are expected to invest in LNG bunkering terminals or bunkering vessels, with demand projected to grow rapidly in global hub ports such as Singapore, Rotterdam, and Busan.

In addition, the demand for materials used in LNG storage and transportation is also expected to be affected. Since LNG must be stored and transported at an ultra-low temperature of -162°C, demand for cryogenic insulation materials such as vacuum insulation panels and aluminum alloys, as well as highly corrosion-resistant and heat-resistant materials, is projected to increase. Key materials used in LNG-powered vessels and bunkering applications include high-nickel steel (9% Ni steel) for cryogenic service, Invar alloy, high-manganese steel, and vacuum insulation panels.

For a standard LNG carrier with a capacity of 174,000㎥, it is estimated that approximately 1,500 to 2,000 tons of high-nickel steel, 500 to 700 tons of Invar alloy, and 10,000 to 12,000㎡ of vacuum insulation are required. A bunkering vessel with a capacity of 7,500㎥ typically uses 600 to 800 tons of high-nickel steel, 200 to 300 tons of Invar alloy, and 4,000 to 5,000㎡ of vacuum insulation panels. These core materials are essential for ensuring stability and efficiency under cryogenic conditions, and are therefore expected to contribute to the continued growth of the materials industry.

▲ POSCO’s independently developed high-manganese steel for cryogenic applications was officially listed in 2022 as a material standard under the IGC Code by the MSC of the IMO. It is now approved for use in cryogenic cargo tanks and fuel tanks for LNG, LPG, and other liquefied gases. The photo shows high-manganese steel being transported by a vacuum suction crane.

I POSCO Group’s Strategic Direction in the Era of Expanding LNG Propulsion

▲ POSCO Group’s first LNG-dedicated carrier ‘HL FORTUNA’.

Starting with the implementation of the GHG pricing mechanism in 2028, the IMO is expected to strengthen taxation standards and raise the per-ton charge over time. As a result, the number of LNG-powered vessels is projected to increase further.

Currently, LNG-fueled ships account for less than 10 percent of the global fleet, with a total of 1,308 vessels. By 2028, the number is expected to exceed 2,300, and the number of bunkering vessels will need to increase from the current 23 to at least 50.

In line with this trend, POSCO Group is introducing LNG-dedicated carriers to respond to the GHG pricing mechanism and other international environmental regulations, while actively expanding its energy business. On May 23, POSCO Group unveiled its first proprietary LNG carrier, HL FORTUNA, at HD Hyundai Samho in Mokpo, Jeollanam-do.

HL FORTUNA is an LNG carrier with a length of 299 meters, a beam of 46.4 meters, and a cargo capacity of 174,000㎥. It is built for transporting North American LNG. The vessel can carry out a single shipment that supplies Korea’s entire population with natural gas for 12 hours. It is fitted with a dual-fuel system that uses LNG as its main fuel, along with a high-efficiency reliquefaction system that cools down boil-off gas and turns it back into liquid fuel, enabling compliance with international environmental regulations.

After completing sea trials, the vessel will go into global LNG trading in the second half of the year. Starting in 2026, it will load cargo at the Cheniere terminal in Louisiana, United States, and will be used for domestic supply and overseas trading. It is expected to make over five round trips annually based on the Gwangyang LNG Terminal, transporting POSCO International’s long-term LNG volumes from North America.

With the introduction of this LNG carrier, POSCO Group has further built up its LNG value chain, covering production, storage, and power generation. Moving forward, the Group plans to keep up with rapidly changing international environmental regulations and seek out new opportunities across its LNG business and other key areas by leveraging group-wide synergies and capabilities.