The trends in POSCO Group’s flagship business area are explained by experts in an easy-to-understand manner. In Part 4, we review the issue concerning “all-solid-state batteries,” which are expected to be next-generation batteries, with Principal Researcher Jae-beom Park at the POSCO Research Institute.

Batteries are mainly divided into primary and rechargeable batteries. Primary batteries, including dry cells and mercury batteries, cannot be recharged after use. On the other hand, rechargeable batteries can be recharged and used multiple times, so they are more environmentally friendly and economically efficient. There are many types of batteries, but the most commonly used rechargeable battery is the lithium-ion battery (LIB).

Compared to other rechargeable batteries, lithium-ion batteries are used in various applications that take advantage of their superior features in all aspects, including lifespan, ease of charging, discharge rate, and costs. In particular, they are widely used in electric vehicles and mobility devices that require long operating range on a single charge due to their high energy density.

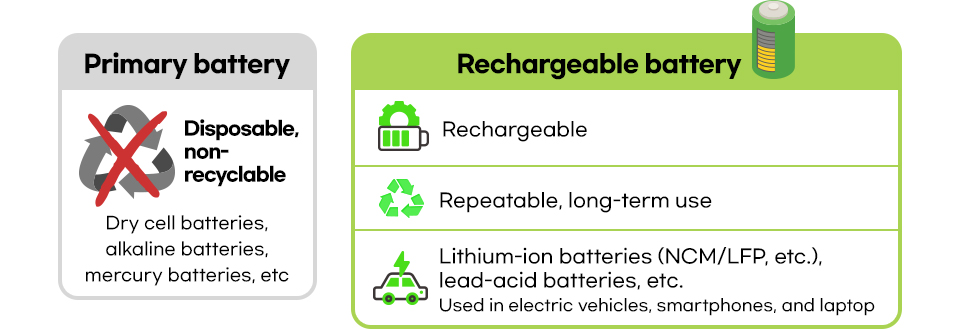

However, even LIB, which is considered the most ideal commercial rechargeable battery to date, requires continuous improvement and supplementation in terms of energy density, price, and stability. To understand why, it is necessary to look at how LIB works.

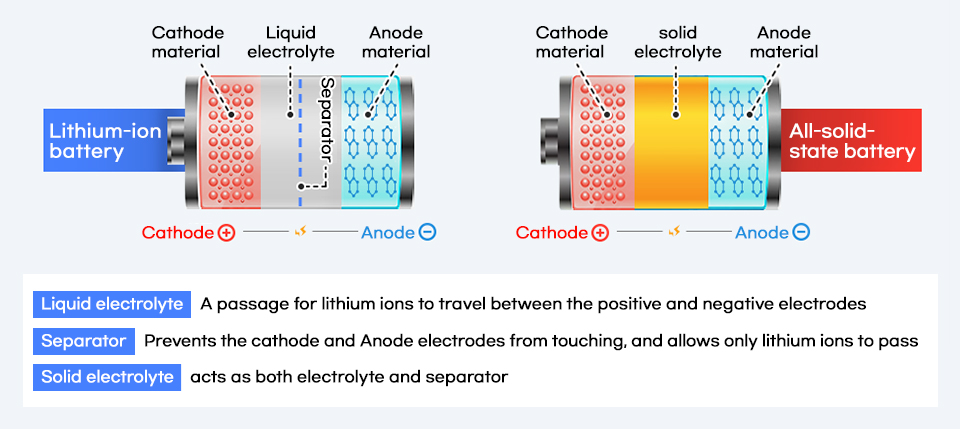

The four core components of an LIB are cathode material, anode material, electrolyte, and separator. Among them, the electrolyte acts as an important medium that helps lithium ions move smoothly between the anode and cathode materials. Since one of the main components of the electrolyte is a flammable organic solvent, there is a risk of fire or explosion in high-temperature environments or external impact situations. To solve this problem, the performance of materials such as anode and cathode materials or electrolytes can be improved, but the ultimate solution is to change the battery type. Post-LIB or next-generation batteries, such as all-solid-state batteries, lithium-sulfur batteries, and sodium-ion batteries, have emerged as solutions, and all-solid-state batteries, which are called dream batteries for dramatically improved energy density and stability, have recently received the spotlight worldwide.

The biggest difference between all-solid-state and lithium-ion batteries is the form of the electrolyte. An all-solid-state battery replaces liquid electrolyte in an LIB with a solid powder. The replacement not only changes the shape but also other LIB materials significantly. It eliminates a separator that prevents direct contact between the anode and cathode during the movement of lithium ions, as the solid electrolyte acts as a separator.

Stability

All-solid-state batteries have many advantages, and stability is the leading example. Since the electrolytes in LIBs are made of flammable organic solvents (liquid), there is a high risk of fire or explosion when the separator that blocks contact between the anode and cathode materials melts due to heat or is damaged for various reasons. However, the solid electrolyte of an all-solid-state battery acts as a separator and more effectively blocks contact between the anode and cathode materials. Therefore, it reduces the risk of fire or explosion. Moreover, the risk of leakage or oxidation due to temperature change or external impact is lower. This means reduced maintenance costs due to excellent ease of use and durability.

Higher energy density

Improved safety helps simplify battery external cases and cooling devices and naturally achieves higher energy density. If the cooling system components can be minimized, the remaining space can be used for battery cells. It will allow improved energy density per battery pack. Moreover, lithium, which has the largest energy capacity among the candidates as an anode material, can theoretically increase the energy density by up to nearly 10 times compared to conventional graphite-based anode materials. Therefore, if we can solve the safety problem of the lithium metal anode material, which is called the ultimate, next-generation anode material, and commercialize it, we can expect to dramatically improve energy density.

Coping with temperature change better

Another big advantage of changing liquid electrolytes to solids is their lower sensitivity to temperature, which allows them to operate over a wider range of temperatures. Conventional lithium-ion batteries mainly operate smoothly between -10°C and 40°C because the ion conductivity* decreases significantly at low temperatures below -10°C, and the risk of thermal runaway increases at high temperatures. On the other hand, all-solid-state batteries operate without problems in a wide temperature range of -40°C to 100°C. Therefore, they can improve the risk of battery discharge in winter or fire caused by high temperatures and can also significantly reduce the need for cooling devices to dissipate heat.

*Ionic conductivity: The degree to which ions contribute to equivalent electrical conductivity in an infinite dilution state

Simplified processes and cost reduction

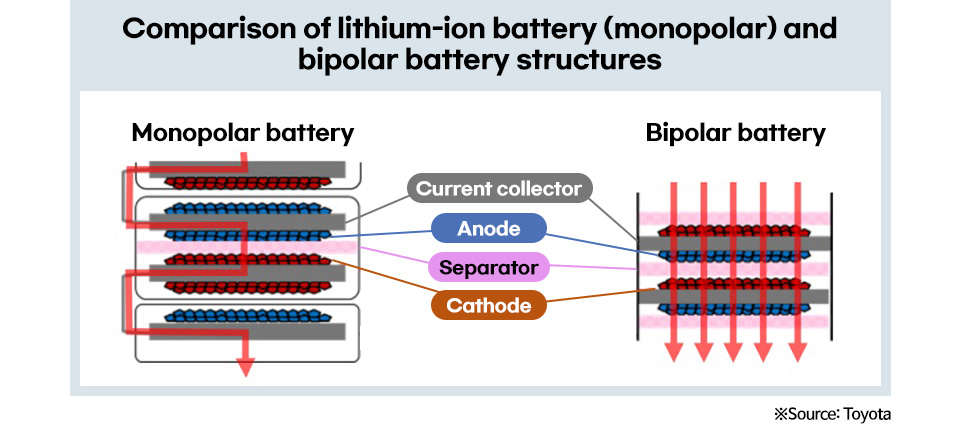

While conventional lithium-ion batteries have a monopolar structure in which a cell has one electrode, all-solid-state batteries can be converted into a bipolar structure in which multiple electrodes are connected in series in a cell. The bipolar structure increases the voltage of the battery by stacking multiple electrodes in a cell, thus increasing the output. Moreover, we simplify processes, increase space utilization, and reduce costs by minimizing the BMS* for external material cooling systems.

*Battery Management System (BMS): A system that monitors the battery status and controls it to maintain the optimal conditions for use

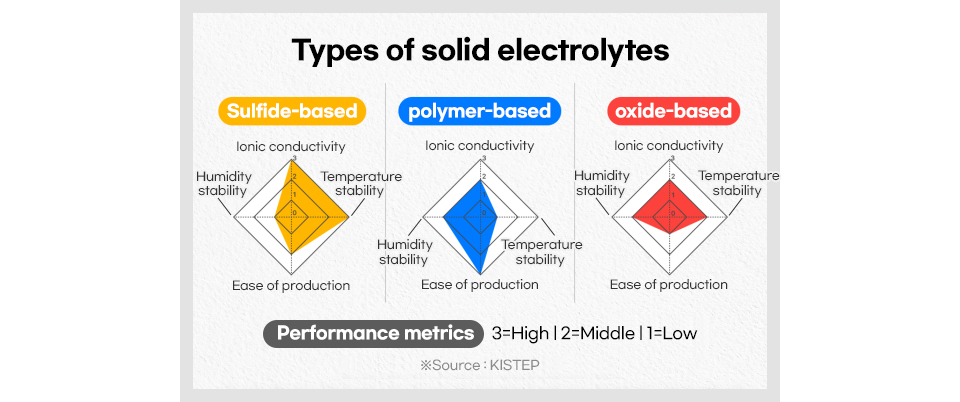

Solid electrolytes used in all-solid-state batteries are largely divided into organic and inorganic types. The sulfide-based type is most likely to be commercialized for electric vehicles, and has attracted the attention of many companies. Sulfide-based materials are relatively soft and form a wide interface* between the electrode and electrolyte, resulting in high lithium ion conductivity.

Various structures depend on the presence of a crystalline structure, even within sulfide-based materials. In particular, solid electrolytes with a structure of LGPS (Li10GeP2S12) or argyrodite (Li6PS5CL), a rare sulfide mineral containing germanium, are known to be able to implement ionic conductivities similar to or higher than the ionic conductivities of general liquid electrolytes (5–10 mS/cm).

*Interface: The boundary between two spatial regions occupied by different substances or physical states of matter

※ Ionic conductivity : LGPS (Li10GeP2S12) 12~25mS/cm, Argyrodite(Li6PS5CL) 2~12mS/cm

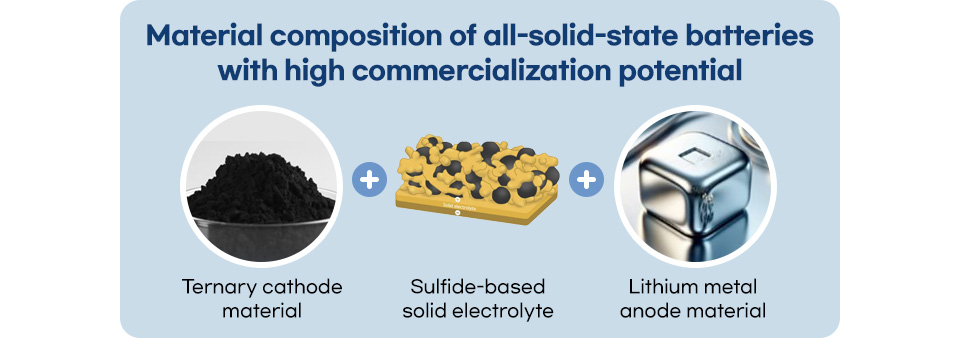

Many companies are actively conducting R&D to create a more perfect all-solid-state battery. While it varies by company, ternary cathode materials* are likely to be the most active cathode material. For anode materials, a transition has occurred from the commonly used graphite-based materials to silicon-based materials, and eventually to lithium metal anodes, which offer higher energy density per volume and weight. Therefore, the material composition of an all-solid-state battery with high commercialization potential is the ternary cathode-sulfide solid electrolyte-lithium metal anode.

*Ternary cathode material: A cathode material in which other elements are added to lithium cobalt oxide (LCO), which is mainly used as a cathode material, for a total of three elements. It is divided into nickel-cobalt-manganese (NCM) and nickel-cobalt-aluminum (NCA).

Leading companies have already announced plans to commercialize all-solid-state batteries by 2027, and they plan to mass produce them by 2030 at the latest. The fact that the original patent related to the composition of sulfide-based argyrodite solid electrolyte, which is considered to have the most commercialization potential, will expire in 2028 is also expected to affect the timing of commercialization.

The University of Siegen in Germany filed a PCT patent application for a sulfide-based source patent in 2008. The patent was later transferred to another company, which now holds the intellectual property rights. When the patent expires in 2028, 20 years from the date of application, many companies are likely to begin mass production of solid electrolytes.

Some companies are also preparing semi-solid-state batteries. Semi-solid-state batteries use gel-type electrolytes that are an intermediate form between liquid and solid. They are being developed to complement the shortcomings of liquid and solid electrolytes and leverage their advantages. Since they can utilize most of the processes of conventional lithium-ion batteries, the technology can be considered a stepping stone before the full-scale transition to all-solid-state batteries.

In addition to technical issues to overcome, such as low ion conductivity and high interface resistance, other important challenges include securing mass production and price competitiveness similar to that of lithium-ion batteries.

The price of the solid electrolyte for all-solid-state batteries is USD 1000/kWh, and excluding other materials, the price significantly exceeds the current price of lithium-ion batteries. This is because lithium sulfide, the core of solid electrolytes, is currently manufactured in labs and pilot lines, and the economy of scale, where the average prices drop as production increases, has yet to be realized.

However, the hope is that, except for some electrolytes that contain rare earth elements such as germanium, the raw material price of general solid electrolytes is around USD 10/kg. In other words, if the production volume can be increased with improved processes, the market price is expected to drop to USD 30/kWh. Reducing the price of solid electrolytes and lithium sulfide and overcoming technical issues are important prerequisites for popularizing all-solid-state batteries.

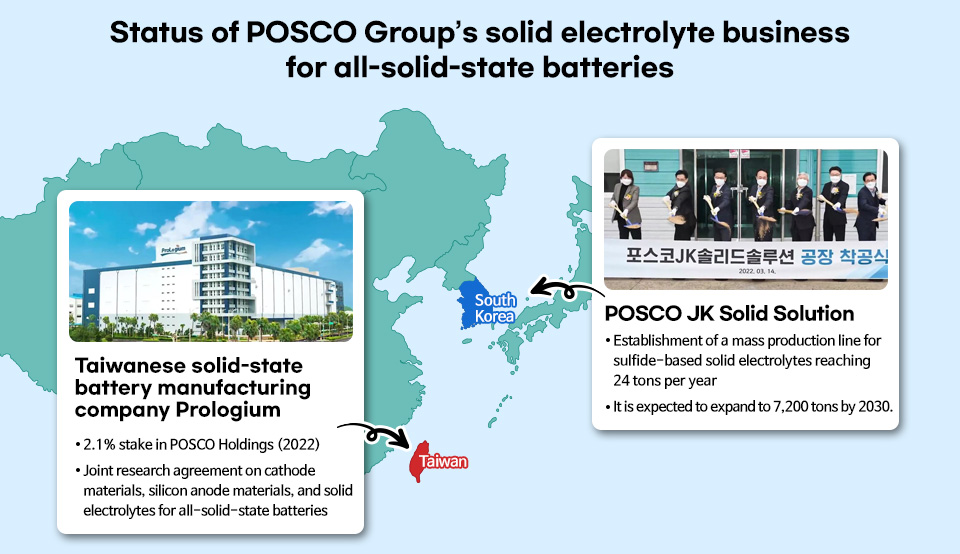

To secure competitiveness in the solid electrolyte business, a key material for all-solid-state batteries, POSCO Group took a 40% stake in Jeongkwan Co., a display materials and parts company, established POSCO JK Solid Solutions as a joint venture in February 2022, and completed the construction of a product plant capable of mass producing 24 tons of sulfide-based electrolytes per year. POSCO JK Solid Solutions is currently preparing for a gradual expansion to eventually increase production volume to 7,200 tons and is conducting tests on all-solid-state battery products with key customers.

Overseas, POSCO invested equity in ProLogium Technology, an all-solid-state battery manufacturer established in Taiwan in 2006, and has expanded the supply chain for all-solid-state battery materials after signing a joint research agreement. Moreover, it is considering various business plans to secure the supply chain for lithium sulfide (Li2S), a key raw material for sulfide-based solid electrolytes.

POSCO Group also has the competitiveness to mass-produce lithium metal cathode materials, which are as important as solid electrolytes in all-solid-state batteries. Since it owns a salt lake in Argentina with high purity and low impurities, it has the advantage of increasing the purity and removing impurities using lithium as an anode material. POSCO is recognized as having the world’s top level technology for lithium purification.

Lithium metal manufacturing requires an ultra-thin and wide production process to economically apply to rechargeable batteries for electric vehicles. The roll-to-roll process, POSCO’s original technology accumulated through rolling and plating processes, is ideal for making the lithium anode ultra-thin and wide. To secure differentiated competitiveness, POSCO plans to apply the process to lithium metal production. It is currently providing samples and conducting tests of lithium metal products using the electroplating method.

POSCO Group is building a full lineup by concentrating its differentiated technologies to secure competitiveness in raw materials for all-solid-state batteries, considered representative next-generation batteries. It plans to continue its efforts to create new added value by responding to the changing global market environment.