The trends in POSCO Group’s flagship business area are explained by experts in an easy-to-understand manner. The global energy market is paying attention to liquefied natural gas (LNG), as an alternative to overcome the limitations of renewable energy. In response, POSCO Group is making every effort to establish a LNG value chain, including offshore gas field projects and the construction of LNG terminals. In Part 5, Senior Researcher Young-geun Joo of the POSCO Research Institute sheds light on POSCO Group’s LNG value chain.

Q What is behind the growing attention to LNG in the global energy market?

While there is a long-term push toward eco-friendly renewable energy and hydrogen, the technologies and economic feasibility of these solutions are not yet fully developed. As a result, LNG is being used as a bridge energy source to replace coal power. The main component of LNG is methane, a molecule made up of one carbon atom and four hydrogen atoms. This structure results in lower carbon dioxide emissions compared to coal or oil. Additionally, the refining process removes impurities, leading to lower emissions of nitrogen compounds, other pollutants, and ultrafine particles.

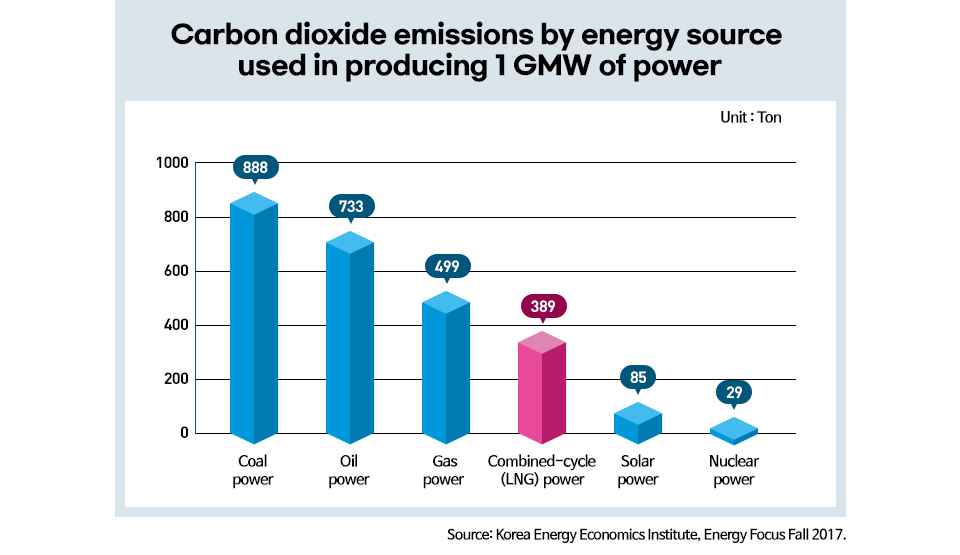

In fact, when generating 1 GMW of power, carbon dioxide emissions vary significantly by energy source: coal power produces 888 tons, oil power 733 tons, gas power 499 tons, combined-cycle (LNG) power 389 tons, solar power 85 tons, and nuclear power 29 tons. While LNG emits more carbon dioxide than renewable or nuclear energy, it shows significantly lower emissions compared to oil and coal power.

Additionally, LNG can also be used as an alternative to address the seasonal and intermittent nature of renewable energy sources and is highly competitive in the global energy market.

Q The LNG value chain has been attracting growing attention. What is the concept of it?

The value chain, described as a “chain of value,” refers to a series of activities through which a company adds value at every step of a product or service process. The process can be divided into stages such as planning and production, distribution, and usage. This entire value chain can then be compared to the flow of a river, categorized into upstream (the upper stream), midstream (the middle stream), and downstream (the lower stream).

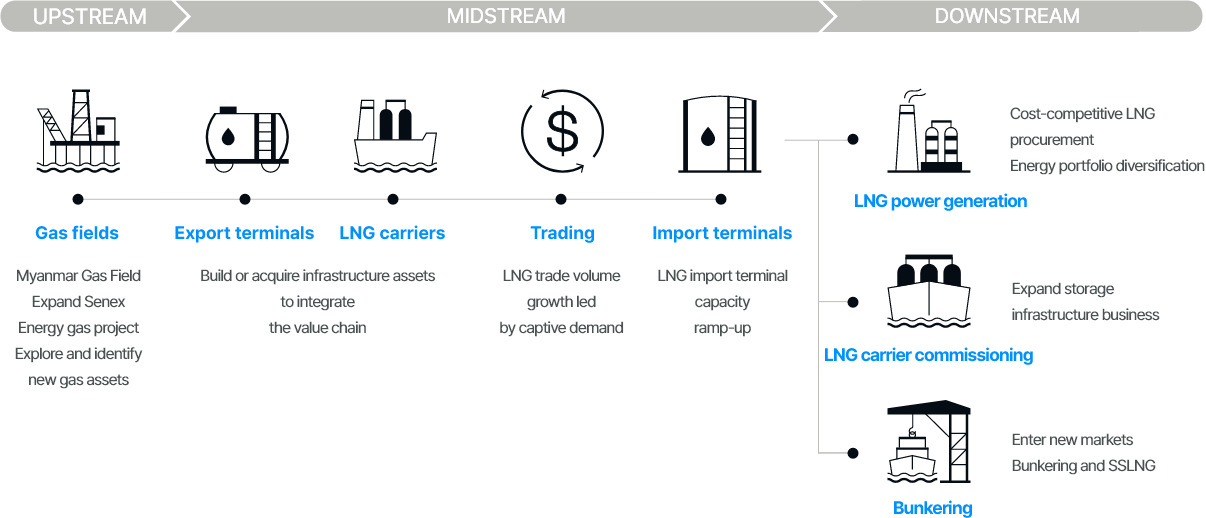

The traditional oil and gas industries simply divide the value chain into upstream (production, distribution, and storage) and downstream (utilization). However, in 2016, POSCO Group added the concept of midstream to enhance LNG terminal capabilities, strengthen trading expertise, improve the integration between upstream and downstream activities, and drive business expansion.

▲ LNG value chain (Source: POSCO International)

First of all, upstream involves the exploration and production of natural gas. POSCO International has been producing natural gas in Myanmar since June 2013, after 13 years of development. Midstream deals with the liquefaction, distribution, and storage of natural gas. This stage includes necessary elements such as LNG export terminals or liquefaction terminals, specialized LNG carriers, and import or regasification terminals like the Gwangyang LNG Terminal. LNG trading, the business of trading LNG, is also part of this phase. Lastly, the downstream stage refers to the demand points where natural gas is consumed. These include POSCO’s steel mills, POSCO International’s Incheon LNG Combined Cycle Power Plant, as well as residential, industrial, and commercial facilities that use city gas.

Q What makes POSCO Group’s LNG value chain stand out?

The energy industry requires massive investments, amounting to trillions of won, with operations producing and consuming tens to hundreds of thousands of tons of natural gas in both upstream and downstream sectors. Amid growing volatility in global energy markets driven by factors such as the Russia-Ukraine war and geopolitical tensions in the Middle East, building an LNG value chain allows POSCO Group to maximize synergies and effectively respond to volatility. POSCO Group produces and consumes a large amount of natural gas, which enhances liquidity and allows it to maintain a stable supply to its downstream operations and use trading, swaps, and other mechanisms to ensure a reliable LNG supply even during disruptions.

In upstream, natural gas must be produced and sold at a high price to generate substantial profits, while in downstream, LNG must be purchased at a low price. By linking these through midstream integration, POSCO enhances price flexibility, creating synergies and boosting profitability in both business and revenue.

Q Where and how does POSCO Group produce natural gas?

POSCO International began offshore exploration in Myanmar in 2000, discovered three subsea gas fields, and has been commercially producing natural gas since June 2013. This project stands out as the largest overseas resource development undertaken by a domestic private energy company. POSCO International transports natural gas through a 105-kilometer subsea pipeline and sells it to Myanmar and China via a gas pipeline linked to an onshore terminal in Kyaukpyu, Myanmar.

The daily production is about 500 million cubic feet, which accounts for 9% of Korea’s annual natural gas consumption. Currently, the company is producing natural gas from three subsea gas fields and discovered another subsea gas field, called Mahar, in a nearby area in 2020.

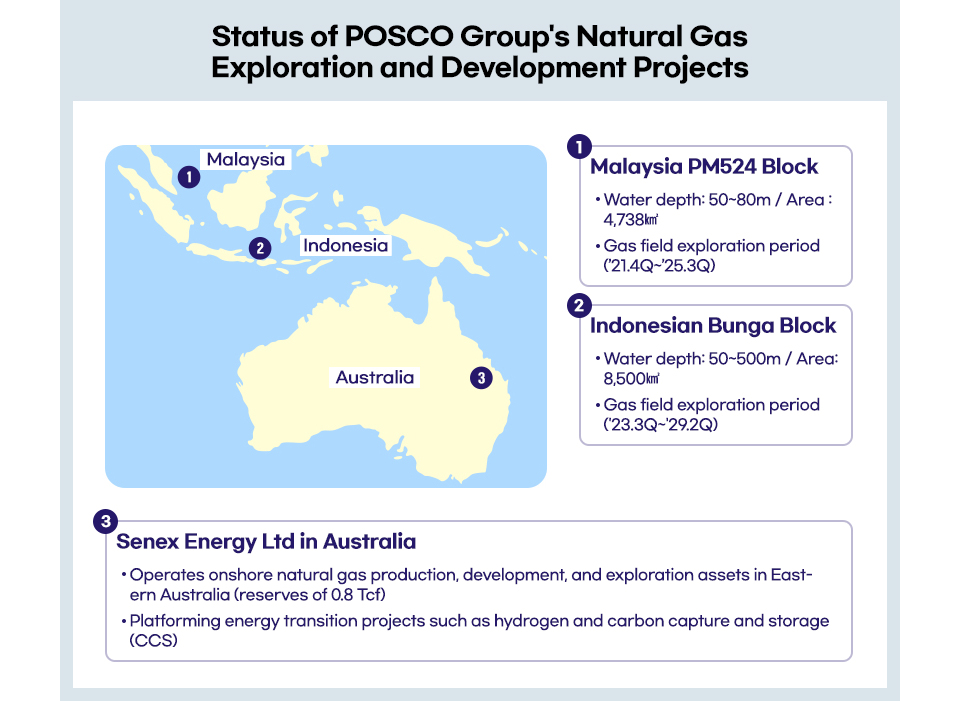

Additionally, POSCO International expanded its upstream operations by acquiring Senex Energy, Australia’s fifth-largest company in the oil and gas sector, in 2022. POSCO International, together with its partner Hancock Energy, plans to invest a total of 650 million Australian dollars by 2026 to acquire Senex Energy and secure natural gas reserves equivalent to 44% of Korea’s annual consumption.

In addition, at the end of 2021, POSCO International won an exploration rights for the PM524 block, located offshore on the eastern side of the Malay Peninsula, from Malaysia’s state-owned oil company, PETRONAS. POSCO International is currently conducting feasibility evaluations and plans to begin exploration and development in 2025. In 2023, POSCO International, through a consortium with Indonesia’s state-owned enterprise PHE*, acquired exploration rights for the Bunga block in Indonesia. The exploration will continue until 2029.

*Pertamina Hulu Energi (PHE): A subsidiary of Indonesia’s state-run oil and gas company Pertamina.

Q What is the capacity of the Gwangyang LNG Terminal operated by POSCO International?

POSCO International began the operation of Korea’s first private LNG terminal in 2005. The company stores imported LNG at the Gwangyang LNG Terminal and uses it for facilities such as POSCO’s steel mills and its LNG Combined Cycle Power Plant.

▲A view of POSCO International Gwangyang 1st LNG Terminal, which was completed on July 9, 2024.

The Gwangyang LNG Terminal 1 currently has six tanks with a storage capacity of 930,000 kℓ. In January 2023, construction of the Gwangyang LNG Terminal 2 began, with plans to add two new tanks (Nos. 7 and 8), each with a capacity of 200,000 kℓ, by 2025. When completed, the terminal will boast a total storage capacity of 1.33 million kℓ with eight tanks, securing its position as the number one private LNG terminal in Korea and the 11th largest worldwide.

Furthermore, in August 2020, POSCO International became Korea’s first certified LNG supplier for vessels and began providing its initial LNG supply to international shipping companies. It is also actively advancing its LNG bunkering business by establishing dedicated infrastructure to supply LNG fuel to marine vessels. POSCO International plans to build a dedicated bunkering infrastructure at the Gwangyang LNG Terminal to stably supply low-carbon fuel to ships, thereby revitalizing the domestic LNG bunkering market and actively responding to international environmental policies.

Q How is the natural gas stored at the Gwangyang LNG Terminal connected to daily life?

In Korea, Korea Gas Corporation (KOGAS) exclusively installs and manages the national gas supply pipeline network, which spans approximately 4,937 km. This network serves as both a transportation channel and a storage system for natural gas. The Gwangyang LNG Terminal converts LNG into natural gas and measures the amount before introducing it into the KOGAS pipelines. Once introduced, the power plants in Incheon withdraw the measured amount of gas for use.

While domestic regulations prohibit the direct sale of LNG gas to third parties in Korea, POSCO International is actively pursuing LNG trading through its Singapore trading subsidiary. In 2023, it traded 2.12 million tons of LNG, equivalent to 4% of Korea’s annual LNG consumption. The company plans to expand its trading volume to 3.57 million tons by 2025.

Q What lies ahead for the global LNG market?

The global LNG market is poised for steady growth, largely due to Europe’s push to replace pipeline natural gas (PNG) and the ongoing shift to greener energy solutions. Qatar, one of the world’s top LNG exporters, has announced that it plans to expand its annual production capacity from 77 million tons to 142 million tons by 2030. Meanwhile, the second term of the Trump administration is anticipated to maximize natural gas production and exports by easing regulatory restrictions on shale gas production and LNG exports.

The Russia-Ukraine conflict has accelerated Europe’s adoption of LNG as a substitute for Russian PNG. For example, despite Germany’s policy of expanding renewable energy, it has recently completed an onshore LNG terminal to secure infrastructure for importing LNG to replace Russian PNG.

In its annual market outlook last August, global energy giant Shell projected that global LNG demand could rise by 50%, reaching between 625 million and 685 million tons by 2040. As we enter a period of global energy transition, we expect LNG to play a key role as a fuel.