Recently, demand for humanoid robots in China has surged, leading to a wave of large-scale supply contracts. In response, Morgan Stanley released its Humanoid Robots 100 report, projecting that the global humanoid robots market could reach as much as USD 60 trillion within the next decade. This article examines the potential of humanoid robots as an industrial mega trend, global technology development strategies, and Korea’s approach to this emerging sector.

Senior Researcher Jeoung-Heon Woo POSCO Research Institute

Humanoid Robots in History

Humanoid robots—machines designed to resemble humans—have appeared throughout history, sometimes as loyal assistants, other times as perceived threats. Examples include the bronze giant Talos from ancient Greek and Roman mythology, the water-clock-powered automaton of China’s Han Dynasty, and Leonardo da Vinci’s “robot knight” from the Renaissance. Across ancient civilizations, human-like machines have emerged in various forms.

Interest in humanoid robots has endured for centuries, accompanied by caution over potential risks. Notably, science fiction writer Isaac Asimov introduced the Three Laws of Robotics in his 1942 short story Runaround, raising philosophical questions about the relationship between humans and machines.

The rapid advancement of AI in recent years suggests that robotics may evolve toward a humanoid robots-centered future. While a “machine” is generally defined as a tool designed to perform production activities using power, a “robot” is an intelligent machine capable of making autonomous decisions under certain conditions.

Modern humanoid robots go further, combining advanced AI with a human-like form factor—a body structure modeled on human anatomy—allowing them to learn work methods, optimize performance, and actively assist in a wide range of human activities.

Physical AI: Extending Intelligence into the Real World

The concept of Physical AI is also gaining attention. Physical AI refers to AI embedded in physical devices—such as robots or autonomous vehicles—that interact directly with the real world. Traditional AI communicated with humans through digital interfaces like text or images, but Physical AI operates in real-world environments, collaborating with humans, perceiving surroundings, and responding accordingly. At CES 2025, NVIDIA CEO Jensen Huang identified Physical AI as a major future growth driver, emphasizing NVIDIA’s role at the center of this technological shift.

ⓒ gettyimagesbank

Why the World is Paying Attention to Humanoid Robots

Humanoid robots are gaining social acceptance and technological attention for two main reasons: form factor suitability and socio-economic potential.

1. Form Factor Perspective

Robots designed for specific repetitive tasks benefit from specialized form factors. However, for Physical AI performing diverse, non-specialized actions in real-world environments, a human-like form factor is advantageous because our physical infrastructure is built for human proportions.

Door handles, stair dimensions, and control panel placements are all designed for human use. Humanoid robots can operate in these environments without costly infrastructure changes, offering high versatility. In contrast, having different standards for each form factor would be inefficient.

2. Socio-Economic Perspective

Humanoid robots’ human-like appearance enables a wide range of human-robot collaboration scenarios, extending beyond manufacturing into customer service, caregiving, education, and guidance. Recent advances in language processing, facial expression recognition, and gesture control have improved emotional engagement, signaling the evolution of robots into social entities.

However, psychological barriers remain. Masahiro Mori, Professor Emeritus at Tokyo Institute of Technology, proposed the Uncanny Valley theory, which suggests that robots that look too human can cause discomfort. This highlights the need to consider psychological acceptance and emotional distance alongside technical perfection.

Economically, humanoid robots are highly promising. Their development requires not only AI but also sensors, actuators, motion control systems, and energy supply technologies. These demands drive innovation across multiple industries, making humanoid robots development a potential growth engine for the future.

Humanoid Robots Industry Structure and Potential Players

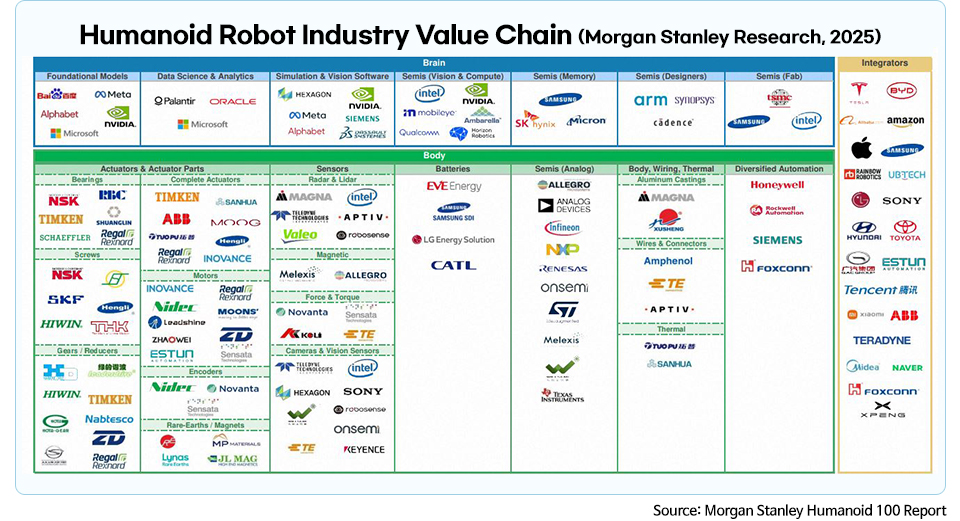

Morgan Stanley’s February 2025 report divides the humanoid robots industry value chain into three core areas: Brain, Body, and Integrator, and identifies potential players in each.

• Brain: Combines software and hardware. Software includes AI models, data science, simulation technology, and vision software. Hardware includes memory and vision computing.

• Body: Includes actuators, components, motors, sensors, batteries, power semiconductors, analog semiconductors, aluminum casting, connectors, heat treatment, and automation systems.

• Integrator: Companies that assemble and integrate the brain and body into finished products. Potential players include Hyundai Motor, Boston Dynamics, Apple, Samsung Electronics, LG Electronics, Alibaba, Amazon, Naver, ABB, and KUKA.

The industry can also be categorized into core components and modules, finished product assembly, and service areas, with the service sector expected to see diverse business models emerge.

Global Technology Leaders: Tesla and NVIDIA and Hyundai Motor

▲ Tesla’s Optimus Gen 2 (Source:Tesla’s official YouTube channel)

The emerging humanoid robots industry is being led by Tesla and NVIDIA, each pursuing distinct strategies.

Tesla is leveraging its expertise in EV production and autonomous driving to develop Optimus, a humanoid robot intended to automate production lines. First unveiled at Tesla AI Day in 2021, Optimus has evolved to perform a variety of tasks. The 2024 Optimus 2 features 40 actuators—12 in the hands alone—allowing it to perform delicate actions such as cracking an egg. Tesla plans to enter the humanoid robots sales market in 2026.

NVIDIA, on the other hand, aims to dominate the humanoid robots “Brain” platform rather than build its own robot. Its Jetson Thor computer, based on the latest Blackwell GPU architecture, enables large-scale AI inference and vision-based decision-making directly on local devices—capabilities previously limited to server environments.

Tesla’s approach resembles Apple’s integrated hardware-software model, while NVIDIA’s strategy is akin to Android’s platform dominance.

▲ Hyundai Motor Company unveils humanoid robot “Atlas” at CES 2026(Source:Hyundai Motor Group official YouTube channel)

In addition to these global leaders, Hyundai Motor introduced its humanoid robot Atlas at CES 2026. Purpose-built for industrial and logistics operations, Atlas offers advanced mobility, precise manipulation capabilities, and seamless integration with Hyundai’s autonomous vehicle and smart factory ecosystems. The debut underscores Hyundai’s ambition to position itself as a key integrator in the humanoid robots value chain, capitalizing on its manufacturing expertise, robotics R&D, and global production footprint.

Securing Leadership in the Humanoid Robots Value Chain

Following smartphones and EVs, the world has lacked a clear driver of technological innovation—until humanoid robots emerged as the next catalyst. As a convergence of cutting-edge technologies, humanoid robots are recognized as a key area for future growth, though challenges remain in cost competitiveness and safety in human-machine collaboration.

Importantly, the humanoid robots industry’s impact will extend beyond AI and software into materials, components, and services. Development and standardization will require core components that meet both functionality and reliability, along with mass production capabilities. In the service sector, opportunities will arise in humanoid robots deployment, human-robot collaboration models, and humanoid robots training and operation.

In June 2025, the Korean government launched the K-Humanoid Robots Alliance, a national robotics and AI consortium involving over 40 domestic industry, academic, and research institutions. AI companies and experts are collaborating with universities to develop AI models for robot manufacturers, with field trials supported by demand-side companies such as POSCO Group.For example, Aei Robot has signed MOUs with POSCO E&C and HD Hyundai Mipo Shipyard to develop humanoid robots for construction sites and shipyards.

Humanoid robots have moved beyond simple robotics to become a central axis of next-generation industrial innovation. Understanding and responding strategically to the technological, industrial, and service trends surrounding their evolution is more important than ever.